Amidst a burgeoning hotel development pipeline in the U.S., marked by the highest counts recorded since Q2 2008 by Lodging Econometrics (LE), there’s been a significant rise in the popularity of extended-stay hotels. This noticeable surge of extended-stay hotels is a result of the way Americans approach lodging. With remote work, flexible schedules and an increased desire for more home-like atmospheres, the extended-stay segment has experienced unprecedented growth in the U.S.

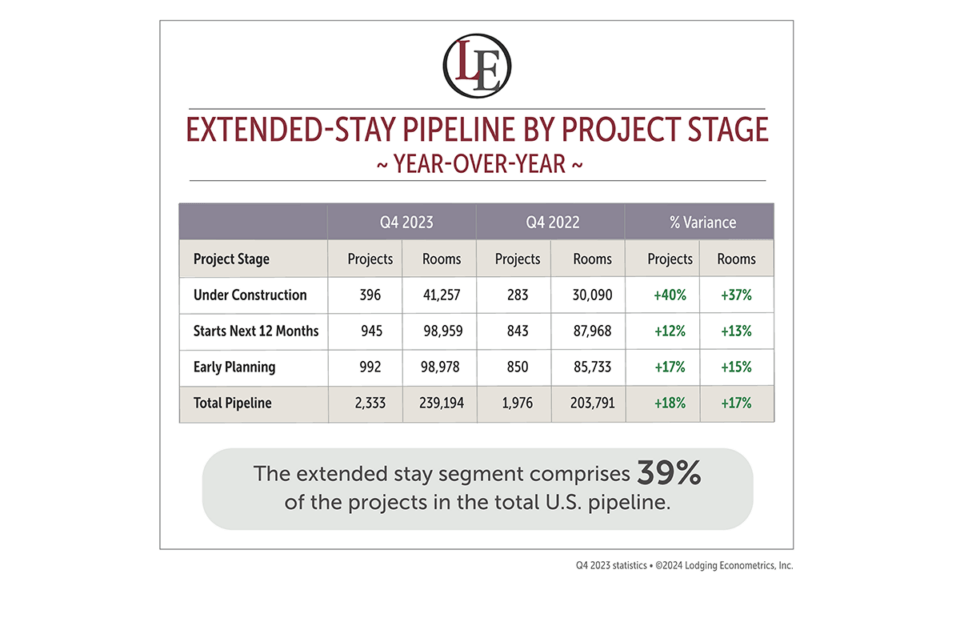

At the close of Q4 2023, the total U.S. hotel construction pipeline reached its highest level for projects with 5,964 projects and 693,963 rooms. Within this extensive pipeline, the extended-stay segment commands a noteworthy presence, constituting 39% of the projects and 34% of the rooms with 2,333 projects/239,194 rooms, respectively. Notably, the past year has seen a surge in the extended-stay sector, experiencing an 18% growth in projects and 17% increase by rooms.

The extended-stay under-construction phase exhibited significant year-over-year (YOY) expansion, escalating by 40% in projects and 37% in rooms, culminating in 396 projects and 41,257 rooms at the close of Q4 ’23. Looking ahead, an additional 945 projects, accounting for 98,959 rooms, are slated to commence construction within the next 12 months, reflecting an increase of 12% by projects and 13% by rooms compared to the same period last year. Furthermore, the early planning stage of the extended-stay pipeline demonstrates no signs of deceleration, witnessing 17% YOY growth in projects and a 15% increase by rooms, concluding the quarter with 992 projects and 98,978 rooms poised for future development.

In response to the evolving preferences of travelers who are increasingly prioritizing accommodations offering the comfort and flexibility of home-like environments, industry leaders have strategically launched new extended-stay brands to cater to the surging demand for long-term lodging and have grown their existing extended-stay portfolios. This proactive approach mirrors a keen response to the shifting dynamics of travel. In Q4 2023, middle-tier extended-stay brands significantly influenced the segment, accounting for 1,467 projects/139,092 rooms. This trend is spearheaded by key players like Home2 Suites by Hilton, boasting 602 projects/61,473 rooms, and TownePlace Suites contributing 402 projects/37,611 rooms. These two brands jointly command 68% of the projects within the middle-tier. In the upper extended-stay tier, Residence Inn stands out accounting for 41% of the projects with 285 projects/34,308 rooms. In total, there are 11 extended-stay brands in the U.S. that have 50 or more active projects in the U.S. construction pipeline.

Looking ahead, LE projects, over the next two years, 37% of the forthcoming projects and 34% of the rooms set to open in the U.S. will belong to the extended-stay category. This forecast translates to the opening of 551 new extended-stay hotels, accounting for a total of 56,347 rooms within the next two years. If all these projects come to fruition, in 2024, LE is anticipating the growth rate of extended-stay brands to reach 4.2%, followed by even more substantial growth of 5.3% in 2025.

For a more in-depth exploration of the extended-stay segment, with project specifics and decision-makers overseeing these developments, contact Lodging Econometrics (LE). As a reliable source, LE not only provides comprehensive data on ongoing projects but also delivers insights into all new construction projects, announced renovations, and brand conversions. Whether your interest is in the U.S. or any other global region, country, or market, LE stands as a valuable resource for staying informed about the latest trends and opportunities in the hospitality industry. 1 603-431-8740, ext. 0025 or [email protected].