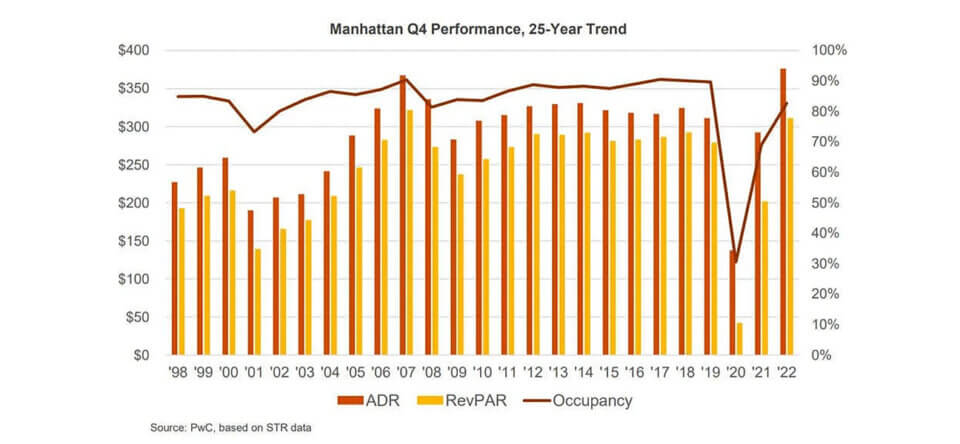

Increases in occupancy, ADR and RevPAR continued to accelerate across Manhattan during the second half of 2022, according to PwC’s Manhattan Lodging Overview.

Q4 RevPAR experienced a year-over-year increase of 54.2%, with the strongest gains in October—up 85.8%. Q3 RevPAR increased 75.1% from the same period in 2021.

“RevPAR exceeded pre-pandemic levels at Manhattan hotels for the first time in 2H 2022, driven by outsized growth in average daily room rates,” said Warren Marr, managing director, PwC. “Hotels continue to struggle with replacing staff lost during the pandemic. With supply growth expected to be muted over the next several years, and a sluggish return of the business traveler continuing to place downward pressure on occupancy levels, hotel operators may begin to see heightened flow through to their bottom lines.”

“RevPAR exceeded pre-pandemic levels at Manhattan hotels for the first time in 2H 2022, driven by outsized growth in average daily room rates,” said Warren Marr, managing director, PwC. “Hotels continue to struggle with replacing staff lost during the pandemic. With supply growth expected to be muted over the next several years, and a sluggish return of the business traveler continuing to place downward pressure on occupancy levels, hotel operators may begin to see heightened flow through to their bottom lines.”

RevPAR increased 54.2% year-over-year during the fourth quarter of 2022. Occupancy and ADR continued to advance in a post-pandemic recovery as group and corporate travel patterns began to normalize and the market experienced its first holiday season with limited pandemic-related restrictions since 2019. Year-over-year increases in occupancy were highest in October, up 32.1%. With overall occupancy for the quarter at 82.7% and ADR at $376.37, Manhattan RevPAR jumped from $201.90 in Q4 2021 to $311.23 in Q4 2022.

Of the four market classes tracked, upper-upscale properties exhibited the most notable year-over-year increase in RevPAR, up 65% for the quarter, driven by a 30.1% increase in occupancy from 63% in 2021 to 82% in 2022, and a 26.8% increase in ADR from $281.11 to $356.51. For upper-midscale properties, occupancy grew by 15.5% and ADR by 41.6%, resulting in a year-over-year RevPAR increase of 63.5%. Upscale properties experienced similar RevPAR growth, posting a 61.6% increase, driven by a 14.9% increase in occupancy and a 40.6% increase in ADR. Luxury properties posted the smallest increase in RevPAR of 37.9%, attributable to an 18.4% increase in occupancy and the lowest increase in ADR among all market classes, up 16.5%.

Of the five Manhattan neighborhoods, Midtown East had the largest increase in RevPAR, up 65.8%, driven by a 29.8% increase in ADR and a 27.7% increase in occupancy year-over-year. Midtown West RevPAR grew by 64.3%, largely driven by a 32.1% increase in ADR. Lower Manhattan and Midtown South posted RevPAR increases of 35.1% and 54.5%, respectively. Upper Manhattan had the smallest increase in RevPAR—still up 30.7%—with ADR growth moderating.

During the fourth quarter, growth in occupancy at full-service hotels outpaced limited-service hotels, with year-over-year increases of 21.1% and 15.1%, respectively. RevPAR increased 54.5% for full-service properties and limited-service hotels saw an increase of 53.3% over the same period.

For chain-affiliated and independent hotels, fourth-quarter RevPAR grew by 56.7% and 48.4%, respectively. The improvement in chain-affiliated hotels was driven by stronger increases in both occupancy and ADR, up 20.9% and 29.6%, respectively.