According to PwC‘s U.S. Hospitality Directions: November 2023 report, leisure demand, while still strong, began to soften in the back half of this year for U.S. hotels as other parts of the world continued to reopen their vacation destinations, and leisure travelers began to once again feel safe traveling abroad.

Increases in individual business travel and group business have not yet been able to fully offset this softening. As a result, occupancy levels have declined in each of the past seven months, relative to comparable 2022 levels, and are expected to continue to be down during the remainder of this year and through at least the first quarter of 2024. Room rate growth had played a significant role in the initial recovery for U.S. hotels but softened significantly in Q2 before falling to below inflationary growth levels in Q3. That said, ADR growth is expected to begin to increase and slightly exceed a declining inflation level beginning in Q4 and into next year.

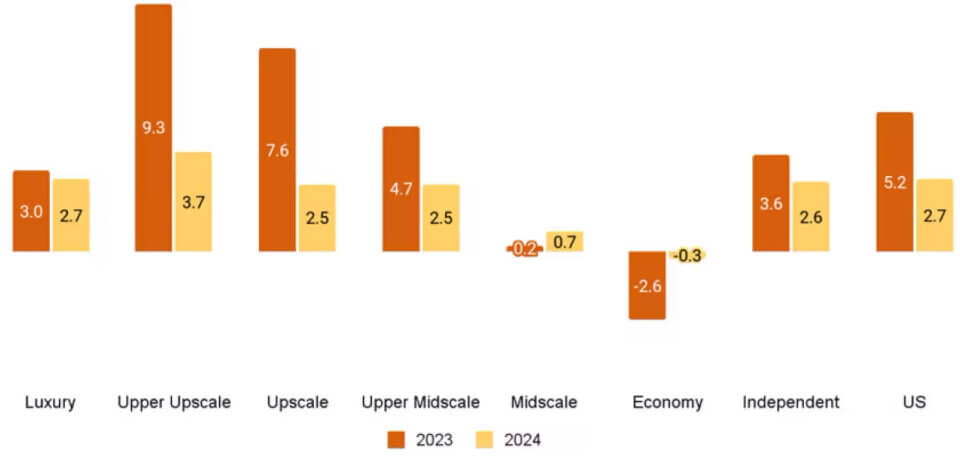

The Fed’s continued increases in its policy rate; continued declines in the public markets since early August; and, more recently, the war in Israel have begun to have a downstream impact on hotel demand. Nonetheless, PwC expects annual occupancy for U.S. hotels this year to increase to 63%. With declines in occupancies for the balance of this year, the company expects ADR to increase 4.5% for the year, with resultant RevPAR up 5.2%, approximately 114% of pre-pandemic levels, on a nominal dollar basis.

“A continued tightening of financial conditions has begun to have an impact on the overall economy,” said Warren Marr, U.S. hospitality & leisure managing director, PwC. “Since our last issue of Hospitality Directions U.S. in May, we’ve seen two consecutive quarters of decline in hotel occupancies and expect to see two more in Q4 this year and Q1 2024 before a gradual rebound. We expect to see RevPAR growth to once again exceed PCE [personal consumption expenditures] inflation beginning in Q2 next year.”

RevPAR percent change, U.S. and chain scales (source: PwC, based on data from STR)

Trends and highlights

- Since the May 2023 outlook, the Fed’s monetary policy has remained a major concern, with no material improvement expected until sometime next year, keeping the availability of debt—that is priced in sync with asking prices for hotel assets—largely unavailable. As a result, transaction activity has been and is expected to remain muted until the Fed adjusts monetary policy in a meaningful way, or the bid-ask spread on hotel assets narrows.

- As we enter 2024, the outlook for midweek travel remains unclear with some companies indicating changes to their business travel policies in efforts to tighten corporate budgets and achieve sustainability goals. Outbound international leisure travel continues to outpace inbound, given the relative strength of the dollar and pent-up demand for international travel following the pandemic. With occupancy levels expected to be relatively flat in 2024, performance gains are once again expected to come almost entirely from ADR, with an expected year-over-year increase in RevPAR of 2.7%—approximately 117% of the pre-pandemic level.

- Significant risks to this outlook include the pace and magnitude of changes in the macroeconomic environment, as well as increasing geopolitical tensions.

2024 outlook

- Demand growth continues to be sluggish during H1 before gradually accelerating in H2, resulting in occupancy of 63.2%.

- Growth in ADR gradually decelerates throughout the year, as the Fed continues to apply pressure on inflation, and finishes up 2.4%.

- As a result, RevPAR growth continues to moderate and ends the year up 2.7%.