Wyndham Hotels & Resorts has revealed that its board of directors received a letter from Choice Hotels International Inc. on Nov. 14. Wyndham’s board, together with its financial and legal advisors, closely reviewed Choice’s letter and determined that it represents a step backward and that the terms Choice outlined are not in the best interests of Wyndham or its shareholders. Wyndham responded to Choice in a letter today.

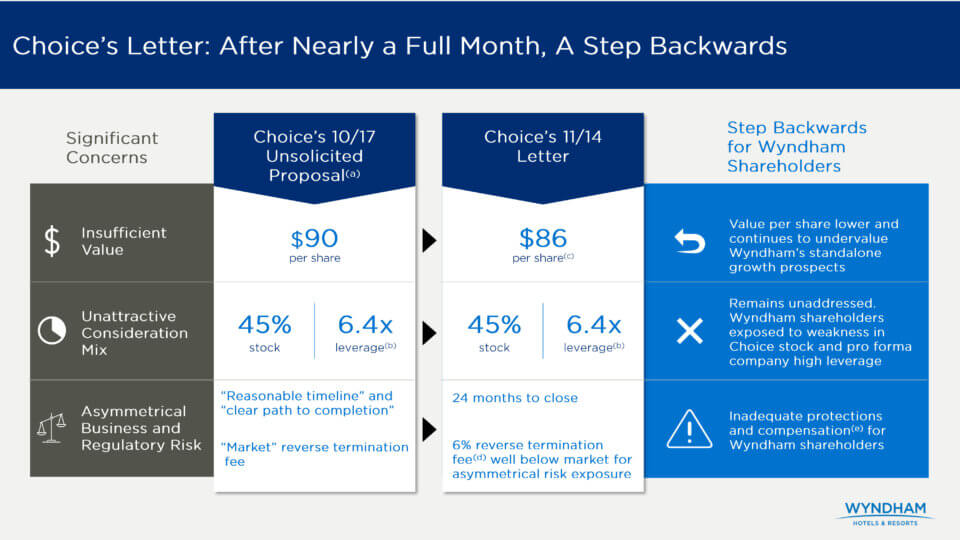

Choice’s first communication in a month since its public disclosure of its unsolicited proposal contains no change to the form of consideration and continues to undervalue Wyndham’s standalone growth prospects, according to Wyndham. At Choice’s current share price, its offer to acquire all outstanding shares of Wyndham stands at a value of $86 per share, below the nominal value of $90 per share proposed on Oct. 17, the date of Choice’s public disclosure. The letter proposes a two-year period for Choice to seek to obtain regulatory approvals supported only by a low 6% reverse termination fee, which would both create a prolonged period of limbo and expose Wyndham and its shareholders to significant asymmetrical risk.

Stephen P. Holmes, chairman, Wyndham’s board of directors, said, “Choice continues to ignore our major concerns around value, consideration mix and asymmetrical risk to our shareholders given the uncertainty around regulatory timeline and outcome. In addition, Choice’s existing proposal is valued at $86 per share, lower than the unsolicited public proposal of $90 per share they made a month ago. Given they now explicitly acknowledge the legitimate issues around the regulatory timeline, they are essentially asking our shareholders to take on serious risk and accept as compensation for a failed deal a low reverse termination fee that doesn’t even begin to compensate for the potential lost earnings and long-term impairment to value that could occur during an uncertain two-year regulatory review. In line with our fiduciary duties, we will of course always evaluate any serious proposal, but Choice continues to fail to adequately address any of the three core issues we have repeatedly raised. They have instead chosen to prolong this for months with a proposal that remains unfeasible, damaging to our business and unnecessarily distracting to our management team.”

The following is the full text of Wyndham’s letter to Choice on Nov. 21 in response to Choice’s letter.

Dear Stewart,

We received Pat Pacious’ letter of November 14 and shared it with our Board of Directors who discussed it at a special meeting.

While you characterize the letter as your fifth, the real question is whether the letter advances the discussion. Unfortunately, this letter does not, and in fact represents a step backwards despite being delivered nearly a full month after you decided to unilaterally go public with your unsolicited proposal.

We have repeatedly articulated three primary concerns: (1) undervaluation of our superior, standalone growth prospects, (2) the value of Choice shares relative to its growth prospects and further compromised by elevated levels of leverage that this deal would require, and (3) the uncertain regulatory timeline and outcome and resulting significant asymmetrical risk to our shareholders.

Unfortunately, despite your assertion to the contrary, your letter fails to adequately address any of these concerns and therefore a combination on the terms you propose continues to not be in the best interest of Wyndham or its shareholders.

As to the first and second concerns, they are not even mentioned in your letter, let alone solved, despite your public comments that you were prepared to address them with available tools and our repeated guidance that an all-cash deal would obviate concerns about Choice’s shares. Also, while you frame your proposal as being $90 per share, it is actually currently valued at $86 per share.

With respect to the regulatory issues and terms, we wanted to first address misrepresentations in your letter, as well as ones that have been raised in prior conversations:

- Neither we nor our advisors have ever described this transaction as “pro-competitive.”

- Neither we nor our advisors have ever stated that clearance of the transaction is certain.

- We have repeatedly expressed our serious concerns and, if anything, they have only increased since you chose to unilaterally go public with your proposal. The reception from the Wyndham franchisee community has been unenthusiastic to say the least, as evidenced by the vehement opposition from AAHOA, which represents about two-thirds of our respective franchisees.

With respect to the proposed terms relating to regulatory matters, while you have put some specific numbers to prior qualitative statements, they continue to fall far short of what is required to address the asymmetrical risk to Wyndham shareholders. Instead, they represent a step backwards in your position.

For the first four months of our interactions, your team repeatedly conveyed confidence that the transaction would clear regulatory approvals within 60 days. Only after repeated conversations with our advisors did your team finally acknowledge the possibility of an in-depth review and Second Request. Your stance has clearly shifted once again on this point: now, you are proposing a two-year period for you to seek to obtain regulatory approvals, which is not at all assured. This significantly exacerbates our concerns about the potential substantial damage and disruption to our business during this time. As we described in our Investor Presentation on October 26, a prolonged period of limbo exposes Wyndham to meaningful risks, including new business development disruption and deterioration in segment-leading retention rates resulting in impaired earnings growth, competitors (including Choice) capitalizing on franchisee uncertainty, stagnated development of our fast-growing ECHO Suites brand, and challenges attracting and retaining team members, among other things. This significant value destruction will impact earnings and compound over time, and potentially cause long-term impairment to our trading multiple.

And these concerns are not merely theoretical. Since May, when your interest was leaked to the Wall Street Journal, your franchise sales team and executive leadership have been actively exploiting the uncertainty around Wyndham that you created to seek a competitive advantage in the market for franchisees and development partners. For example, your representatives have told owners and prospects that completion of the acquisition is a “100% certainty,” in an apparent attempt to discourage them from doing business with Wyndham. While our best-in-class management team has been working actively to mitigate this threat, this risk would only grow worse in the event of a signed transaction with a possible two-year timeline.

While your proposal of a 6% reverse termination fee (ironically calculated off the current $86 per share value of your offer) finally quantifies your prior public comments about a “market” fee, we have consistently told you that such a fee does not even begin to compensate for the damage to our business in the event the deal does not close after an extended regulatory review, a concern made even worse by your new proposal for a 24 month drop-dead date. Given your advisor’s recent characterization of your confidence level in the deal closing being “100%,” we are deeply puzzled by your unwillingness to agree to a robust fee that protects us in circumstances that you see no chance of ever happening.

Our Board of Directors remain faithful fiduciaries representing the best interests of Wyndham and its shareholders and other stakeholders and stand ready to evaluate and engage in discussions if you make a proposal that adequately addresses each of the three significant concerns we have raised on multiple occasions. Given your persistent unwillingness to adequately and promptly address the three concerns that have been consistently communicated or to abandon your current proposal, we are compelled to make our response public as we are not prepared to expose Wyndham’s business to continued uncertainty, from which you benefit competitively.

Sincerely,

Stephen P. Holmes

Deutsche Bank Securities Inc. and PJT Partners are serving as financial advisors and Kirkland & Ellis LLP is legal advisor to Wyndham.