Days after the U.S. repealed its Covid-19 testing requirement for inbound air travelers, the U.S. Travel Association released its full biannual forecast for travel through 2026—including both travel spending and volume—which projects that all segments of travel, in spite of rising inflation, will surge in the short term due to pent-up demand and consumer savings. However, this is not expected to last, leading to slower growth in the later years of the forecast.

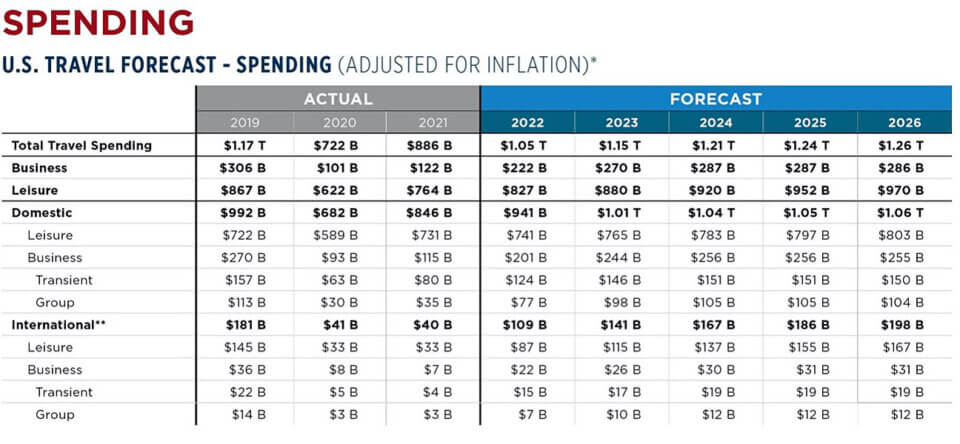

U.S. Travel estimates that $1.05 trillion (in 2019 dollars, adjusted for inflation) will be spent on travel in the U.S. this year, but this is still 10% below 2019 levels and 16% below where it should have been if not for the pandemic. The table below reflects annual spending estimates, adjusted for inflation, through 2026.

The forecast, based on analysis from Tourism Economics, projects that domestic business travel volume will reach 81% of pre-pandemic levels this year and 96% in 2023. However, domestic business travel spending, when adjusted for inflation, will not fully recover to pre-pandemic levels within the range of the forecast.

U.S. Travel is advocating for federal policies that would accelerate the business travel sector’s recovery. In a recent letter to U.S. Treasury Secretary Janet Yellen, U.S. Travel called for the agency’s support on a tax extenders package that includes a temporary restoration of the entertainment business expense deduction and an extension of full expensing for business meals. These policies are also key priorities for U.S. Travel’s Meetings Mean Business Coalition.

Domestic leisure travel will continue to drive the overall U.S. travel industry’s recovery in the near term, though spending is projected to remain $46 billion below where it should have been this year had the pandemic not occurred.

International inbound travel is making strides toward recovery, aided by the recent repeal of the inbound pre-departure testing requirement. The sector is projected to grow rapidly through the rest of the year, and then grow at a slower pace in 2023-2026. A full recovery to pre-pandemic levels (volume and spending) is not expected until 2025.

However, policy changes can also help accelerate that timeline. If the U.S. reduces wait times for visitor visa interviews to less than 30 days, the U.S. could gain an additional 2.2 million international visitors and $5.2 billion in spending by the end of the year. U.S. Travel has several policy proposals to restore visa processing operations worldwide:

- Develop a pilot program for the use of videoconferencing technology in visa interviews with low risk, returning visa applicants and visa applicants with urgent or time-sensitive travel.

- Prioritize visa processing resources to the embassies and consulates that have high demand.

- Temporarily extend all visitor visas for a year or waive visa interview requirements for applicants seeking a valid renewal particularly for those presently in the U.S.

- Consider allowing certain low-risk visa holders currently in the U.S. to renew their visa while staying in the U.S.

- Develop new ways to make the visa process more efficient for medium-to-large group travelers.

- Delay and reconsider the proposed non-immigrant visa fee increase.

U.S. Travel expects to next revise its biannual forecast in the fall.