Hotel management system provider RoomRaccoon has unveiled its annual global report, RoomRaccoon Report 2022, “A Year of Impact: What’s Next?” The report analyzed the booking data of thousands of independent properties in 54 countries around the world.

The data covers key hotel performance indicators such as occupancy, RevPAR, booking lead time, length of stay, international and domestic travel, direct and OTA bookings, as well as upsell performance to forecast trends shaping the hotel industry in 2023.

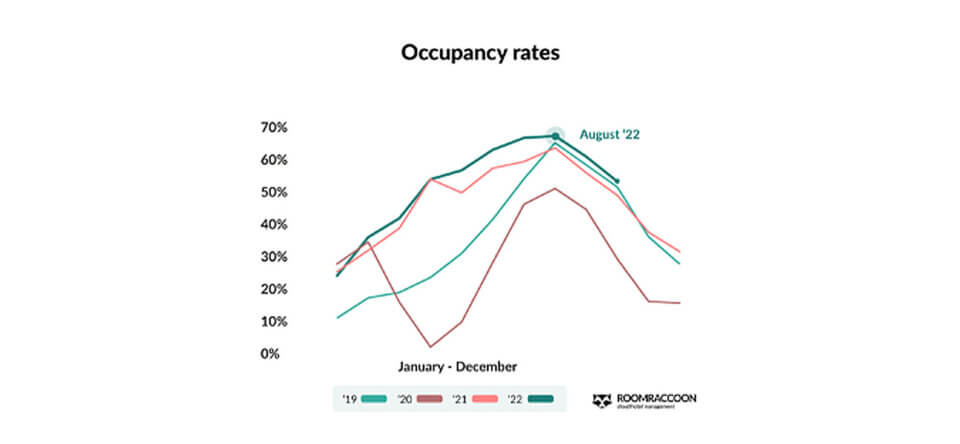

Highlighting the speed at which the sector has recovered from the pandemic, the report reveals that guests are returning in greater numbers, with occupancy levels reaching and exceeding parity with pre-pandemic levels. In August, RoomRaccoon’s clients in Europe had record-breaking occupancy levels averaging 64% in comparison to 61% in August 2019.

Some of the findings:

- Direct bookings are on the rise. Direct bookings have been on an upward trajectory, increasing by a staggering 169% from 2019. This reflects the continued desire of guests who want greater control over their accommodation bookings.

- Hotels are generating better revenue. Revenue per available room (RevPAR) this year is up 46% compared to 2021. The data reflects a spike in RevPAR over the European summer season, hitting a record-breaking $105 on Aug. 13.

- Memorable experiences outweigh rising inflation. This year, RoomRaccoon clients that use automated upsell technology received some of the highest ancillary revenue performances recorded with room upgrades, breakfast, early check-in/late checkout and a bottle of champagne among the top-performing add-ons.

- Domestic tourism is still going strong. Despite a 33% increase in hotel bookings from international travelers, domestic bookings account for 64% of bookings this year and will continue to present significant business opportunities for hotels.

- Booking lead time returns to normal: The average hotel booking lead time is on par with pre-pandemic levels, measuring 30 days this year in comparison to 31 days in 2019. This shows a shift in travelers’ confidence as restrictions are eased and the travel landscape stabilizes.

“Despite predictions that hotel occupancy would not return to pre-pandemic levels until 2023, recovery has come sooner than expected,” said Tymen van Dyl, CEO/cofounder, RoomRaccoon. “This will come as encouraging news to the industry. However, challenging economic times and soaring inflation could weigh the pace of recovery in the new year.”

He continued, “For me, the importance of making decisions driven by data is more imperative than ever before. With the industry rapidly evolving and the dramatic shift in guest behavior, analyzing the numbers has become the most effective way to track patterns, develop appropriate strategies and understand where your efforts, and money are best spent. Going forward, it will be imperative that hotels use data to inform their marketing and commerce strategy to ensure they remain competitive and maximize revenue despite uncertain economic times.”