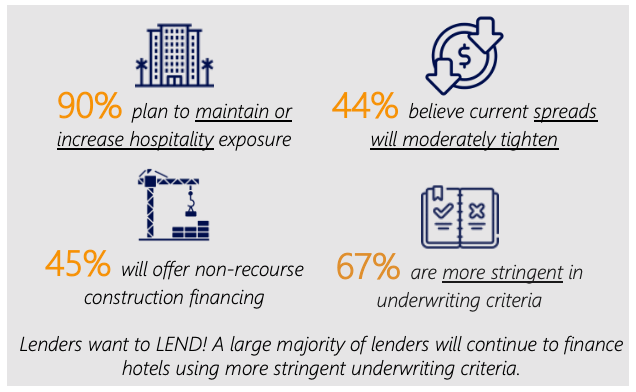

Real estate investment banking firm RobertDouglas’s Ninth Annual Lender Survey, just released, found that despite rising interest rates, inflation and recessionary fears, lenders remain active in the hotel sector, with more than 90% planning to maintain or increase hospitality exposure.

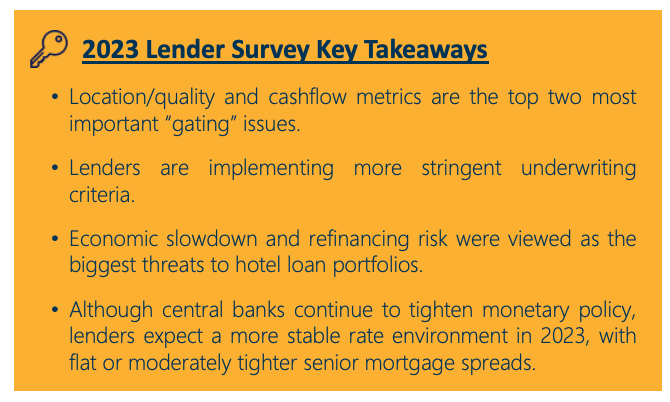

Location and quality of the asset continues to remain the most important “gating” issue for loan requests, with cash flow metrics such as debt yield or debt service coverage ratio a close second, especially for traditional bank lenders. However, debt funds continue to accept a wider range of underwriting metrics to provide liquidity to challenged assets.

More than three-fourths of lenders surveyed did view an economic slowdown or external factors as the biggest threats to hotel loan portfolios, consistent with previous years’ surveys. At the same time, while hotel lenders remain optimistic and active, today’s increasing borrowing costs and higher exit cap rates are dampening underwriting activity at present.

On a positive note—although central banks continue to tighten monetary policy, lenders expect a more stable rate environment in 2023, with flat or moderately tighter senior mortgage spreads. The outlook for 2023 and beyond is cautiously optimistic and signals more liquidity in hotel lending markets over the coming months.

RobertDouglas conducts its annual lender survey to measure the current state of financing market conditions and ascertain critical future expectations through the lens of the specialist hospitality lending community. Providing insights on the metrics most important to lenders in the underwriting, sizing and pricing of hotel loans, the study includes financing originators from life insurance companies, debt funds, conduit lenders and banks.

About RobertDouglas

RobertDouglas is a real estate investment banking firm with offices in New York, Los Angeles, San Francisco, Nashville, and Chicago that specializes in the sale, financing, and equity capitalization of hotel, resort, and gaming properties throughout North America. Founded in January 2013 and currently led by its four partners, Rob Stiles, Doug Hercher, Stephen O’Connor and Evan Hurd, RobertDouglas offers access to exceptional domestic and international institutional investor and lender relationships as it combines the capital markets sophistication of top-tier investment banks with diligent hotel underwriting and proven asset management experience.

To receive a full copy of the RobertDouglas 2023 Hotel Lender Survey, email [email protected]