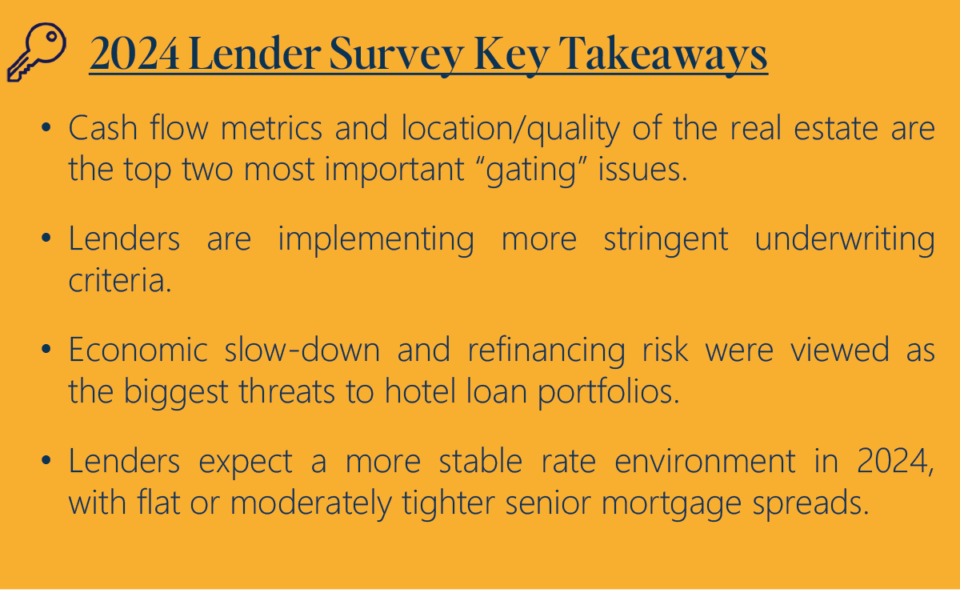

Real estate investment banker RobertDouglas’ 10th Annual Lender Survey, just released, found that with inflation persisting and recessionary anxieties lingering—even as interest rates plateau—lenders in the hotel sector maintain engagement but have tightened underwriting standards to mitigate economic vulnerability.

As a result, cash flow metrics and location/quality of the real estate are the top two most important “gating” issues. Debt funds, while providing crucial liquidity to struggling assets, are scrutinizing a broader spectrum of metrics to assess creditworthiness, as economic slow-down and financing risk are viewed as the biggest threats to hotel loan portfolios.

However, 95% of lenders expect no significant distress within their existing portfolio.

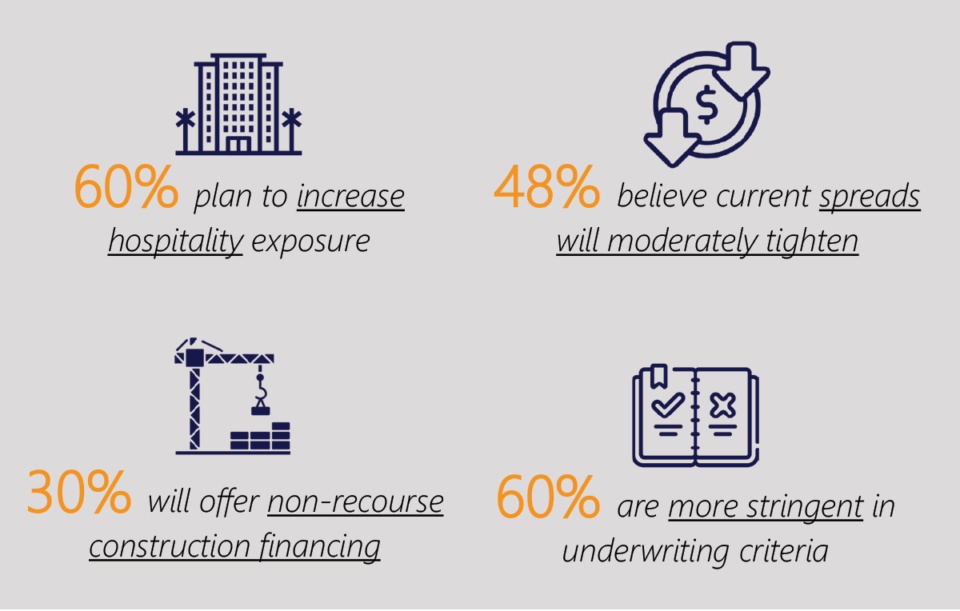

Of note, reinforcing a sense of caution, in this year’s survey, 60% of lenders reported that they plan to increase hospitality exposure, as compared to last year’s survey when 90% reported that they had planned to maintain or increase hospitality exposure. Similarly, this year, 30% of lenders reported that they will offer non-recourse construction financing, a reduction from the 45% that reported they would in last year’s survey.

Looking to 2024, most lenders expect origination volumes to moderately increase or remain flat. Approximately 40% of lenders reported that they are confident in future hotel performance and nearly half anticipate values to remain relatively flat.

RobertDouglas conducts its annual lender survey to measure the current state of financing market conditions and ascertain critical future expectations through the lens of the specialist hospitality lending community. Providing insights on the metrics most important to lenders in the underwriting, sizing and pricing of hotel loans, the study includes more than 70 financing originators that including life insurance companies, debt funds, conduit lenders and banks.

About RobertDouglas

RobertDouglas is a real estate investment banking firm with offices in New York, Los Angeles, San Francisco, Nashville and Chicago that specializes in the sale, financing and equity capitalization of hotel, resort and gaming properties throughout North America. Founded in January 2013 and currently led by its four partners, Rob Stiles, Doug Hercher, Stephen O’Connor and Evan Hurd, RobertDouglas offers access to exceptional domestic and international institutional investor and lender relationships as it combines the capital markets sophistication of top-tier investment banks with diligent hotel underwriting and proven asset management experience.

To receive a full copy of the RobertDouglas 2024 Hotel Lender Survey, email [email protected]