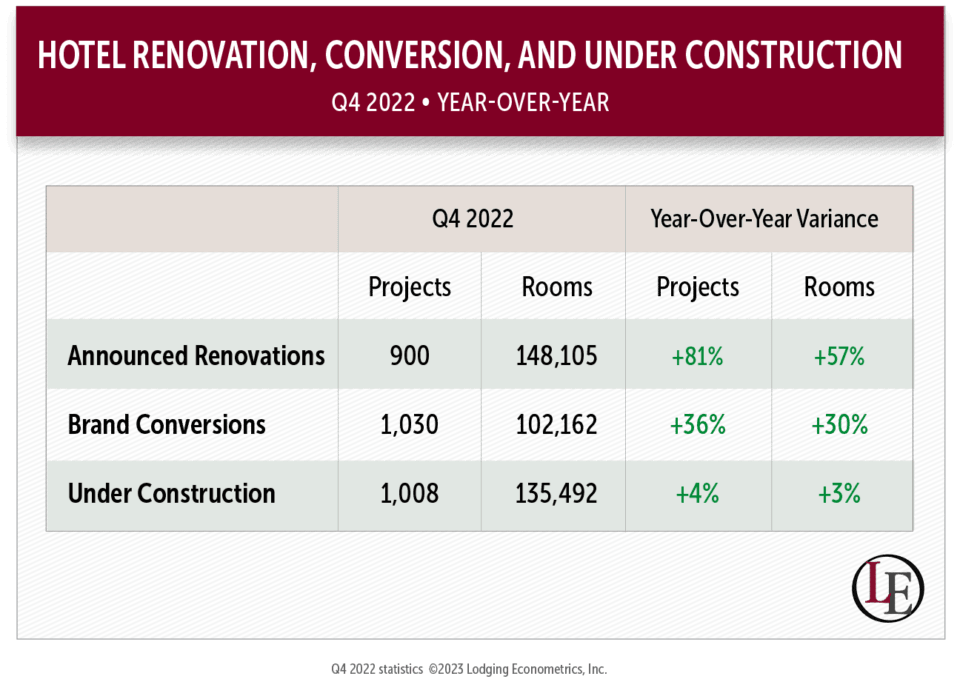

Hotel renovation and conversion pipeline activity, at the end of the fourth quarter of 2022, is at the highest totals Lodging Econometrics (LE) has ever recorded. Renovations and conversions account for more projects and rooms than those that are currently in the under construction stage of the new construction pipeline. At the end of Q4 ’22, there were a total of 1,008 projects/135,492 rooms under construction in the U.S.

Renovation and conversion activity, at the end of Q4 ’22, combined for a record-high project count of 1,930 projects/250,267 rooms. Renovation totals amounted to 900 projects/148,105 rooms and an all-time high conversion total of 1,030 projects/102,162 rooms, at the end of Q4 ’22. Year-over-year (YOY) renovations and conversions combined have increased 54% by projects and 45% by rooms, while the under construction stage of the pipeline has grown 4% by projects and 3% by rooms YOY.

Renovations and conversion activity is especially important to understand at this stage in the real estate cycle as it represents immediate sales opportunities for vendors, brand growth opportunities for franchise companies, and a changing market dynamic for ownership and management groups. All which LE can help you understand and act upon.

Accounting for 35% of the projects and 29% of the rooms in the combined renovation and conversion pipeline, the upper-midscale chain scale leads the way with the most activity. This chain scale has 428 projects/47,687 rooms of renovation, and another 251 projects/23,792 rooms in the conversion pipeline, for a total of 679 projects/71,479 rooms. The upper-midscale chain scale also has the largest amount of construction activity in the U.S. with 2,175 projects/219,005 rooms. The economy and upscale chain scales follow upper-midscale in terms of renovation and conversion activity.

Of the 1,030 conversion projects in the pipeline, 345 of those or 34% are currently unbranded hotels that are slated to convert to a brand. One hundred and seventy-six of the unbranded hotels will move to a brand within the upscale, upper-midscale and midscale chain scales. Tapestry by Hilton, Comfort Inn and the Best Western brand being among the brands most favored in their respective chain scales.

LE also found that of the total hotel conversions in the U.S., over half the hotels converting, or 535 hotels/504,489 rooms, were moving up market or remaining in the same chain scale. Whereas there are 150 hotels/18,121 rooms going down market or to a lower chain scale.

Markets with the most renovation and conversion activity at the end of Q4 ’22 include Atlanta with 42 projects/4,399 rooms; Houston with 40 projects/4,640 rooms; Chicago with 38 projects/5,129 rooms; the Texas West Area comprised of cities like El Paso and Waco, with 36 projects/3,078 rooms; and San Diego with 31 projects/4,726 rooms. It’s no surprise that areas like Atlanta, Houston and Chicago top the renovation/conversion pipeline, as they are also some of the top markets in the U.S. for new construction as well. Heavy renovation, conversion, and new construction activity can rapidly and dramatically change local market dynamics for owners, management, and franchise companies.

LE is forecasting renovation and conversion activity to remain strong throughout 2023.

For more information on hotel renovations and brand conversions, by market, franchise company, brand, chain scales, and more, contact Lodging Econometrics at 603-431-8740 ext. 0025 or [email protected]. We can provide you with the insights you need to stay ahead of your competition and increase your revenue growth.