PHOENIX—The second day of The Lodging Conference at the JW Marriott Desert Ridge Resort here brought more networking, deal making and sharing of industry knowledge.

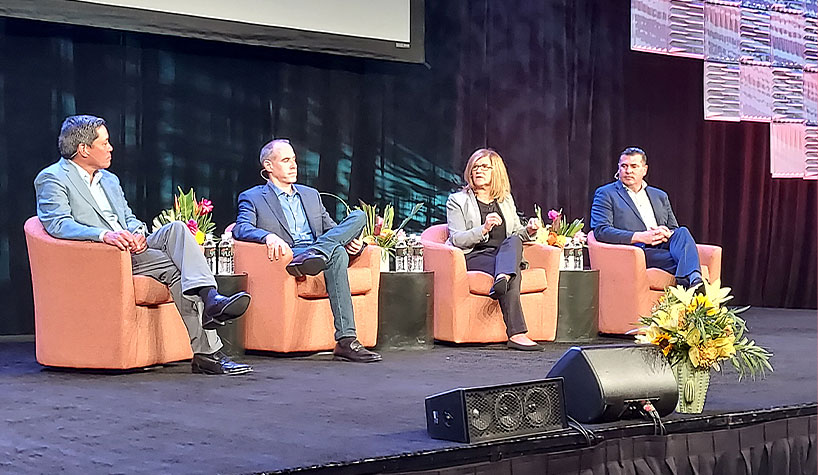

During the morning general session, “Deals: Development, Investment, M&A,” moderated by Ken Greene, president/CEO, AAHOA, industry execs offered their take on issues the state of those areas of hospitality.

Here are some takeaways:

Jim Chu, EVP, global franchise & development, Hyatt Hotels on whether deals are happening: “I think that deals will happen. I think it will continue to pick up right now. Everybody was waiting for stressed pricing, which as we all know, really hasn’t come as a general matter. So, I think there has to be, an updated expectation on what returns are. When the deals are happening, there has been an adjustment on what the expectation on what returns on capital has been and that has changed.”

Greg Friedman, managing principal/CEO, Peachtree Hotel Group, on while deals weren’t happening and what the near-term looks like: “It is starting to get more active on the equity side. From the standpoint of…the last 15 months, everybody is sort of betting on the fact, especially going back to…May and June of 2020, a lot of people expected that there would be this huge opportunity to buy for huge discounts and getting this ‘COVID discount.’ It really never came to bear. Finally, you’re starting to see, at least on the equity side, you’re starting to see more and more trades where there’s a little bit more certainty on where things are pricing out and I think just given where the market is headed. Candidly, I think there’s a lot of motivating factors that are going to drive potential asset sales in the fourth quarter of this year.”

Brian Quinn, chief development officer, Sonesta International Hotels, spoke of opportunities from the pandemic relating to operations: “There is a huge opportunity that we have yet exploit with the pandemic. Let’s innovate a bit and get back to finding things that are value propositions for both the owner and the guests…There are things hanging out there, around breakfast, around housekeeping, around activities, around acceleration and the use of technology. Let’s get after it…The pandemic taught us you not only have to think about what could happen, but things that you may have even thought about that were never going to happen have happened and what are you going to do if they happen…We have the opportunity to innovate our way out of some of this, and put some new tools franchisees and owners’ hands around how to tear through their P&L and find some new margins.”

Allison Reid, chief development officer, Kimpton Hotel Group, on where to invest: “I would invest what I know, where I know. I would look at what’s my capital? What’s my time horizon? What are my investment returns? Am I investing in a segment that I understand? Am I investing in a market that I understand? Because, like anything, things evolve, things change. Who believed 9/11 or COVID would happen? So, these are long-term investments. So, if you’re saying, ‘I need to go where the money’s going, I don’t really understand this segment but everyone’s going there…That is a recipe for disaster. The sponsor is the primary issue for lenders. Does this sponsor know what they’re doing? So, if you know what you’re doing. If you know a segment invest there.”