Recent transactions include Hawkeye Hotels acquiring a Hotel Indigo property in Pittsburgh; Pebblebrook Hotel Trust completing the sale of a Sofitel hotel in Philadelphia; and more.

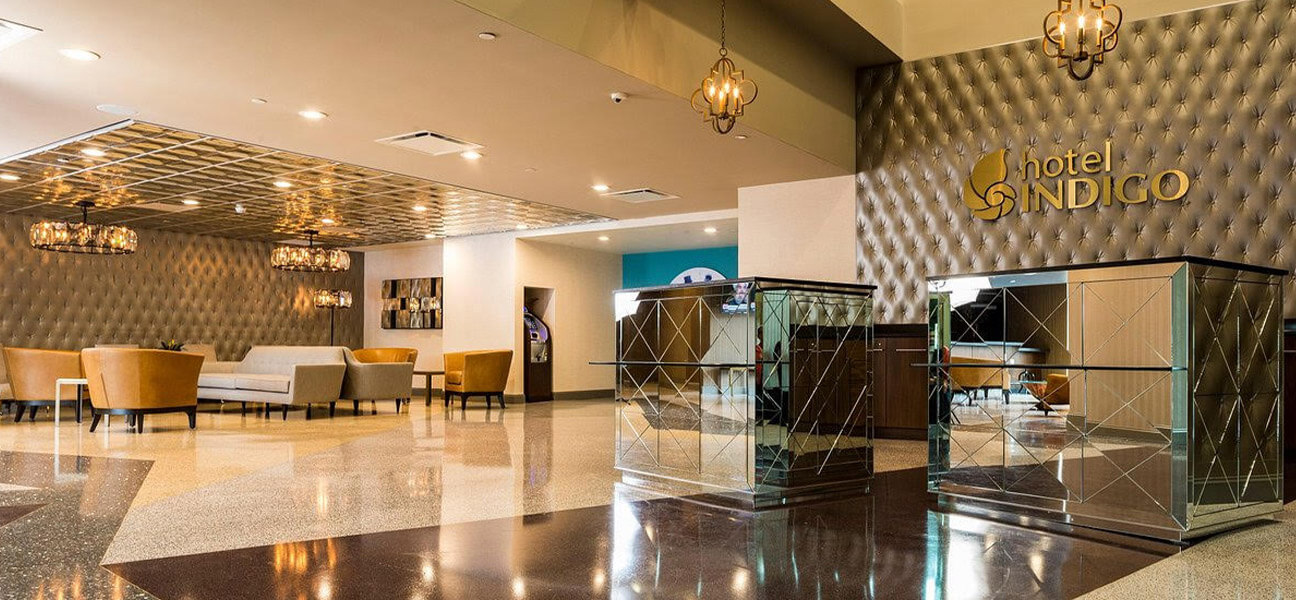

Hawkeye Hotels acquires Hotel Indigo Pittsburgh East Liberty

Hawkeye Hotels, with the assistance of Berkadia, has successfully acquired the Hotel Indigo Pittsburgh East Liberty.

With this acquisition, Iowa-based Hawkeye Hotels continues its growth in the Northeast, making this its third hotel owned and operated in Pennsylvania. The company is positioned to continue acquiring and developing hotels, including an additional upscale extended-stay hotel in Erie, PA, to add to its recently opened Holiday Inn.

Hotel Indigo Pittsburgh East Liberty is a restored boutique hotel in the heart of Pittsburgh’s historic East Liberty Neighborhood. It is located close to the Carnegie Museum, Carnegie Mellon University, the University of Pittsburgh, Phipps, Heinz Chapel, St. Paul’s and East Liberty Prebsyterian Church.

Pebblebrook Hotel Trust completes sale of Philadelphia Sofitel

Pebblebrook Hotel Trust has closed on the sale of the 306-room Sofitel Philadelphia at Rittenhouse Square in Philadelphia for $80 million to a third party.

For the trailing 12 months ended June 30, the hotel’s net operating income was $3.1 million and its hotel EBITDA was $3.8 million. Based on the hotel’s operating performance for 2019, the sales price reflects a 10.0x EBITDA multiple and an 8.6% net operating income capitalization rate. The net operating income for both periods mentioned above is after an assumed annual capital reserve of 4.0% of total hotel revenues.

Proceeds from the sale of Sofitel Philadelphia at Rittenhouse Square will be used for general corporate purposes and reducing the company’s outstanding debt borrowings associated with recent hotel acquisitions, in accordance with its investment strategy.

WoodHouse acquires Elevation Hotel & Spa

WoodHouse has acquired the Elevation Hotel & Spa in the ski town of Crested Butte, CO. Elevation is the only luxury ski-in, ski-out resort located at the base area of the Crested Butte Mountain Resort (CBMR) in Colorado’s Elk Mountain Range, according to the company.

The 262-room hotel was purchased from Boxer Property & Resorts, which has controlled and operated the hotel since 2013. The Elevation will remain independently owned by WoodHouse, while Highgate has been contracted to lead the hotel’s daily operations.

Plans for the property’s reimagining are still in early development and will be shared at a later date. The hotel will remain in full operation throughout the summer and forthcoming ski season.

Sonnenblick-Eichner arranges sale and acquisition financing for Surfsand Resort

Sonnenblick-Eichner Company has arranged a $58-million sale and $40.6-million of acquisition financing of the fee simple and leasehold interests in the Surfsand Resort, a beachfront resort located in Cannon Beach, OR. The 95-room hotel is the only full-service resort on the Oregon coast, according to the company. The resort was purchased by Vesta Hospitality.

The new ownership is planning a $9-million renovation that will further enhance the resort and its amenities. Cannon Beach is the closest high-end destination beach resort to Portland and Seattle, according to Sonnenblick-Eichner Company. Offering nine miles of coastline, Cannon Beach offers natural attractions including Haystack Rock, one of the largest coastal monoliths in the world.

“Given the unique institutional quality of this oceanfront property, we were able to orchestrate a competitive sale process resulting in a transaction that had minimal contingencies and a timely closing,” said Elliot Eichner, principal/cofounder, Sonnenblick-Eichner Company. “Recognizing that we had financed the resort three times previously for the seller, the buyer engaged us to finance their acquisition and renovation of the property.”

Concord Summit closes $109M of loans for two Orlando-area projects

Concord Summit Capital LLC has arranged two construction loans totaling $109 million in the Greater Orlando Area. Managing Director Kevin O’Grady, Director Justin Neelis and Senior Analyst Daniel Rojo of the company’s Miami office were the exclusive advisors and sourced the financing on both.

The company arranged for Centennial Bank to provide a $54-million loan to build Embassy Suites at Sunset Walk, a 300-unit, for-sale condominium-hotel project in Kissimmee. The developer, Encore Opportunity Fund, is offering buyers furnished and designed condo-hotel residences. Construction has already started.

It also arranged a $55 million construction loan for The Registry at Grass Lake, a 320-unit market-rate apartment community in Winter Garden being developed by L.M. Sandler & Sons. The lender is American Momentum Bank.

Concord Summit has financed all of Encore’s components within its Sunset Walk entertainment masterplan community. This is the third loan Concord Summit has arranged in Sunset Walk in the last 12 months.