On day two of the 43rd annual NYU International Hospitality Investment Conference virtual event, industry CEOs touched on a number of topics related to the pandemic and recovery during the session, “CEOs’ Think Tank: How Strong Leaders Adapt to Change.”

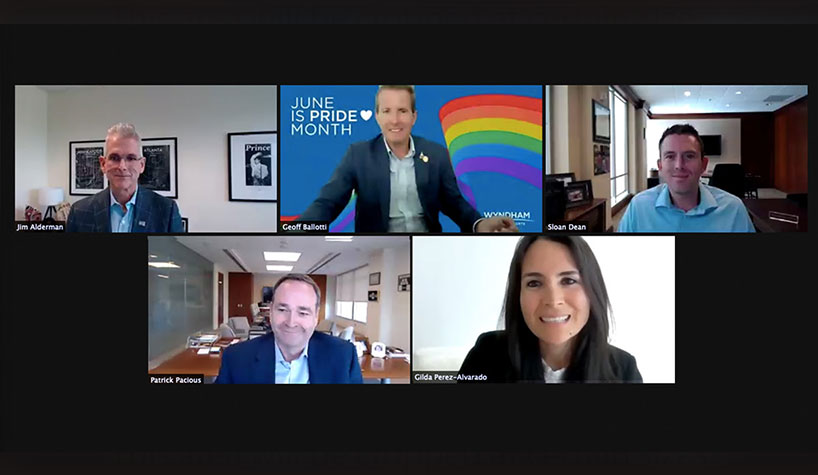

Moderated by Gilda Perez-Alvarado, global CEO, JLL Hotels & Hospitality, the panel included Jim Alderman, CEO, Americas, Radisson Hotel Group; Geoff Ballotti, president/CEO, Wyndham Hotels & Resorts; Sloan Dean, CEO/president, Remington Hotels; and Pat Pacious, president/CEO, Choice Hotels International.

Perez-Alvarado started the session by asking Ballotti what he has learned from consumers during the pandemic.

Ballotti replied, “The one thing that’s impressed us all is just the resiliency of the leisure traveler and how that leisure traveler has been replacing so much of what we lost back in March, April and May, and how much travel demand there is and continues to be in will be this summer and into the fall and next year from that leisure traveler.”

He also has been surprised by the fact that the average leisure traveler is younger than ever before. “We all have to market to them in a different way, cast a wider net and expand our marketing funnels to appeal to these folks,” he said. “They don’t necessarily know our brands, so we need to reintroduce them to our brands.”

Pacious sees two trends that were popular before the pandemic continuing to this day. “First is a longer length of travel vacation,” he said. “If you look at these alternative lodging models, that’s what you see. It’s not that one- to two-night stay; it’s that week-long stay or longer. The second is the experience seeker: those that are going to a local market and to experience the food and the culture and the like.”

Dean was asked about how his company is attracting group business to his hotels. Technology, he noted, has played a very important role.

“We are currently using video and 360-degree imagery in virtual tours, so a lot of our meeting planners are not coming to the hotel; they are virtually walking around with the technology showing them the space,” he said. “We also have social distancing diagrams of all our meeting space that we use to sell to meeting planners. And, we partnered with AllSeated, which is a platform that allows meeting planners to log in, design a room from their own computer and then we can work with the teams to make that come to life.”

He gave his forecast on when business travel will return. “I think It’s going to be in waves,” Dean said. “We are already seeing small and mid-size now, with SMERF [social, military, education, religious and fraternal] this summer. We’re seeing small to mid-size corporate in the fall, and large [groups] starting in Q4/Q1. We anticipate leisure-driven markets to be back in ’22, and we’re seeing that at some of our resorts. Our city center group houses like Boston and L.A., we don’t expect to be back until 2023.”

On the challenges from an operations perspective, Alderman commented, “Hotels are still in recovery mode when it comes to staffing up. So, the first focus is to try to assist in thoughtfully staffing up as fast as possible and stabilize any deferred maintenance that might have happened during this downturn.”

He added that there has been some miscommunication with guests over the fact that the traditional hot breakfast went away for the time being.

“There’s been a little suffering of NPS [net promoter scores] because it wasn’t maybe explained to the traveling public that…there will be no open buffet breakfast, so you’ve had to make changes there,” Alderman said. “A lot of people who are paying don’t necessarily like a bag of fruit and yogurt as a substitute for a hot breakfast. We need to thoughtfully bring that back. I’m sure there’s a giant segment of the owners that would love to not bring it back at all, ever. But that’s not going to fly. The first one that breaks means everyone breaks, so of course, we’re going to have to jump back into it.”

Pacious has been impressed with how quickly travelers are returning. “We finished May with a minus 4% RevPAR performance versus 2019 levels; that’s way beyond our expectations,” he said. “April was the same way. We had a record Saturday night for our company on Memorial Day weekend. We signed up 56,000 loyalty program members over that weekend.”