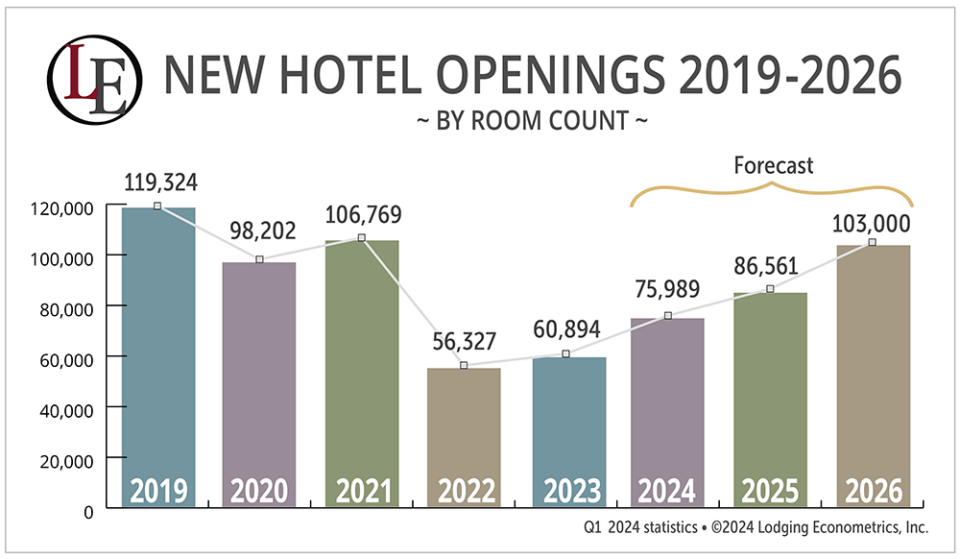

The number of projects in the hotel construction pipeline in the U.S. hit a new all-time high in Q1 2024 with 6,065 projects/702,990 rooms, according to the latest hotel development statistics from Lodging Econometrics (LE). Despite this robust pipeline, new hotel openings have not yet returned to pre-pandemic levels. However, given the size of the current pipeline, LE is forecasting new hotel openings to rise significantly in the near term and approach pre-pandemic levels in 2026 (see chart).

To consider the trajectory of new hotel openings, it is imperative to provide an overview of the past along with LE’s projections for the future of new hotel openings. Certainly, before the pandemic hit, the U.S. hotel industry was experiencing a steady stream of new openings. In 2019, there were 1,023 hotels representing 119,324 rooms that opened. This marked a significant year for hotel openings. Back then, and not too dissimilar from today, the industry was generally healthy, with strong demand supporting new developments and expansion. As the effects of the pandemic began to unfold, the U.S. hotel industry saw a continuation of projects already in motion. In 2020, despite the challenges, 843 hotels comprising 98,202 rooms opened their doors. The following year, 2021, marked a significant milestone as well, as the industry continued to navigate through COVID-19, and by year-end 829 hotels had opened with 106,769.

However, at year-end 2022, new hotel openings saw a dramatic decline, nearly halving the number of new hotel openings compared to 2021, with 476 hotels and 56,327 rooms. The following year, 2023, there was only a slight uptick, with a mere 4 additional hotels and 4,567 rooms opening compared to 2022, totaling 480 hotels and 60,894 rooms. Yet, signs of recovery are evident now. In the first quarter of 2024 alone, 114 hotels comprising 15,506 rooms opened in the U.S. Based on developer opening dates, LE is forecasting an additional 547 projects, totaling 60,483 rooms, to open by year-end 2024. This would equate to a total of 661 projects and 75,989 rooms, reflecting a growth rate of 1.3% by rooms. If all these projects open as planned, 2024 will witness the opening of 181 more hotels and 15,095 more rooms compared to 2023.

Looking ahead to 2025 and 2026, new hotel openings will continue to climb. According to LE’s projections, there are expectations for 790 projects and 86,561 rooms to open in 2025. This would represent a 20% increase in new hotels and a 14% increase in new rooms compared to 2024, with a growth rate of 1.5% by rooms. The forecast for 2026 is even more optimistic, with the potential to bring U.S. new hotel openings nearly back to pre-COVID levels. According to LE, 2026 is estimated to end the year with approximately 103,000 new hotel room openings.

Lodging Econometrics (LE) is continuously tracking hotel development across the U.S., and in every region, country and market globally. We are updating construction project stages, construction start and open dates, developer and owner contact information, yearly forecasts for new hotel openings and much more. For more information on individual hotel development projects by project stage, their projected open dates and project decision-makers, contact Lodging Econometrics at info@lodgingeconometrics.com or 603-431-8740, ext. 0025.