ORLANDO, FL—Wyndham Destinations Inc., vacation ownership and exchange company, reported positive fourth quarter and full-year 2018 financial results for the period ended Dec. 31, 2018.

Highlights include:

- Fourth quarter net revenue increased 3% to $956 million and gross VOI sales increased 5% to $564 million

- Due to favorable tax adjustments in 2017 related to U.S. tax reform, fourth quarter income from continuing operations decreased 76% to $106 million and diluted EPS from continuing operations decreased 75% to $1.10

- Further adjusted EBITDA increased 3% to $240 million in the fourth quarter

- Further adjusted diluted EPS for the quarter increased 14% to $1.27

- Delivered full year net cash provided by operating activities from continuing operations of $292 million and further adjusted free cash flow of $580 million

- Repurchased 2.6 million shares of common stock for $100 million in the fourth quarter and an additional $40 million through Feb. 25

- Full-year 2019 Adjusted EBITDA is projected to be between $995 million and $1.015 billion

- The Board of Directors authorized a 10% increase in the quarterly dividend to $0.45 per share

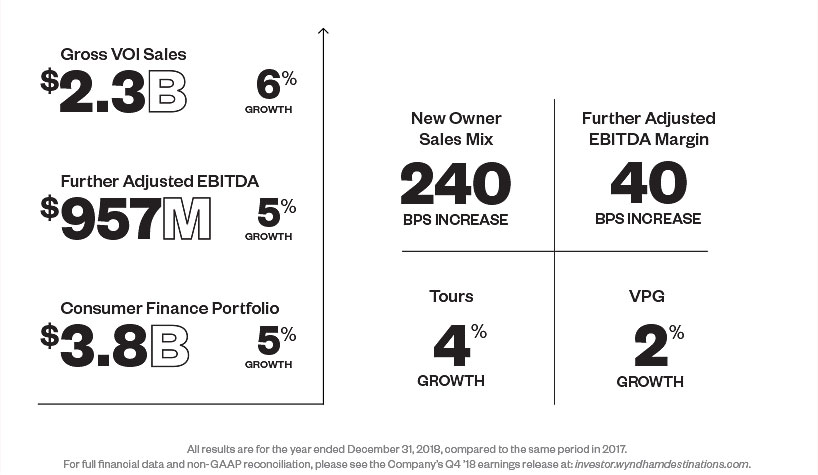

Michael D. Brown, president/CEO of Wyndham Destinations, noted, “We are very pleased with our fourth quarter and full-year results. We continue to make progress against our strategic objectives which delivered 6% growth in full-year gross VOI sales and a 240 basis point improvement in our new owner mix, all while preserving margins. Our industry leading margins combined with a capital efficient business model helped generate strong free cash flows and provide strong returns for shareholders.

“As we begin 2019, our priorities remain the same—delivering great vacations and countless memories for our owners and members while providing strong returns for our shareholders. Since the spin-off through today, we have returned $385 million of capital to shareholders in the form of dividends and share repurchases.”

During the fourth quarter of 2018, reported revenues, income from continuing operations and income from continuing operations per diluted share were $956 million, $106 million and $1.10, respectively. This compared to reported revenues of $931 million, income from continuing operations of $444 million and income from continuing operations per diluted share of $4.36 in the fourth quarter of 2017. Total fourth quarter 2018 adjusted EBITDA from continuing operations increased 8% to $241 million, primarily driven by an increase in gross VOI sales and cost savings initiatives.

During the full-year of 2018, reported revenues, income from continuing operations and income from continuing operations per diluted share were $3.9 billion, $266 million and $2.68, respectively. This compared to reported revenues of $3.8 billion, income from continuing operations of $646 million and income from continuing operations per diluted share of $6.22 in 2017. The year-over-year decrease in income from continuing operations was due to a $407 million tax benefit in 2017 due to the U.S. Tax Cuts and Jobs Act. Total full-year 2018 adjusted EBITDA from continuing operations increased 7% to $942 million, primarily driven by an increase in gross VOI sales and cost savings initiatives.

Company Results — Further Adjusted

Further adjusted results are presented as if Wyndham Hotels & Resorts were separated from Wyndham Destinations and the sale of the European rentals business was completed for all periods presented.

During the fourth quarter of 2018, further adjusted net income was $123 million and further adjusted diluted earnings per share (EPS) was $1.27. Further adjusted EBITDA was $240 million, compared to $234 million in the fourth quarter of 2017. The company’s guidance range was $235 million to $243 million.

Full-year 2018 further adjusted net income was $480 million and further adjusted diluted EPS was $4.84. Further adjusted EBITDA was $957 million, compared to $914 million in the full-year of 2017. The Company’s guidance range was $952 million to $960 million.