NEW YORK—With the growth of the digital economy, businesses need to make regular, mass cross-border payouts to their partners overseas. Facilitating these payouts in a timely, cost-effective, secure and transparent fashion is increasingly critical for their success.

But there’s one major challenge that businesses face. “Unlike payment acceptance, for which there are hundreds of well-established service providers with clear points of differentiation, solutions for cross-border payouts are still emerging, with current service providers offering a wide range of options, which have unique benefits and disadvantages,” said Peter Shore, general manager, Transpay.

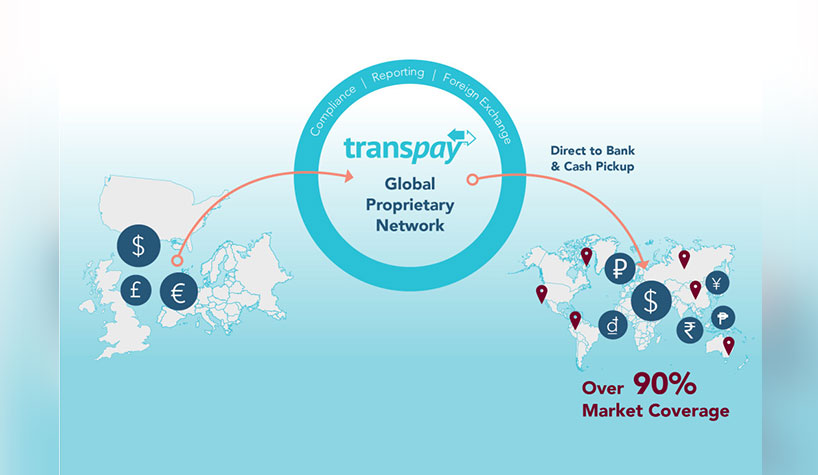

Transpay, a cross-border payout platform, aims to solve the challenges of paying globally. The company is able to pay from point A to point B without intermediaries and hidden fees.

“We offer direct-to-bank payouts through our own proprietary network. This is an alternative to e-wallets, prepaid cards and wires. While these all do the job, they incur extra, usually hidden fees and risks, as you depend on multiple intermediaries,” said Shore. “We are transparent and, in many cases, a faster route to reach the payees wherever they may be. From a compliance point of view, we have an experienced in-house team who ensures that the payments are coming and going as per the law in every jurisdiction. Since we own the transaction from initiation to completion, we can control the full movement and, thus, avoid regulatory risks.”

Among the company’s clients are OTAs, who are looking for speed of payout as well as clarity on what the exact amount received will be.

“Payables are quick, ensuring no under or overpayment when currency needs to be exchanged. They usually want the most cost-effective, lower-risk option. Most of the OTAs rely on properties based in ‘exotic’ locations that are not easy to reach from a payment point of view,” he said. “We are an enabler for those harder-to-reach markets.”

Transpay’s services are available through multiple platforms, with many OTAs using the company’s application programming interface (API), while others opt to use a batch process and web services to initiate payouts. Transactions are sent to the platform by the client through their preferred interface, and Transpay executes on those instructions to deliver funds in the country.

“Transpay is authorized and licensed in over 70 jurisdictions worldwide that allows for safe and secure direct-to-bank payouts in nearly every country,” he said. “We screen both payer and receiver on every transaction to ensure a company does not inadvertently run afoul of not only global lists, but local as well.”