The lodging industry landscape continues to fluctuate week-to-week, and Lodging Econometrics (LE) is tracking and updating all the hotel development activity in every region, country and market globally. Within the last 30 days, LE has updated more than 8,000 existing projects and hotels in its global database of hotel and contact records. LE has added more than 200 new renovation and brand conversion projects and 450 new construction pipeline projects, globally. In the U.S. alone, during this same timeframe, LE has added or updated more than 3,700 projects and hotels including 89 new renovations and brand conversion projects.

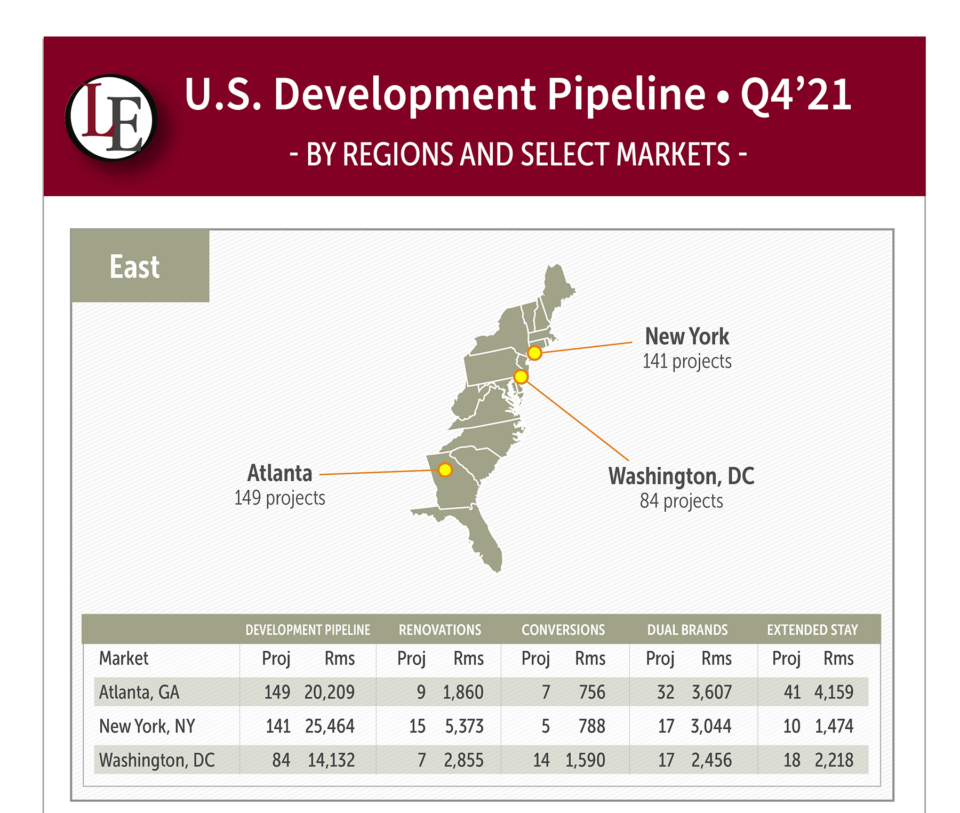

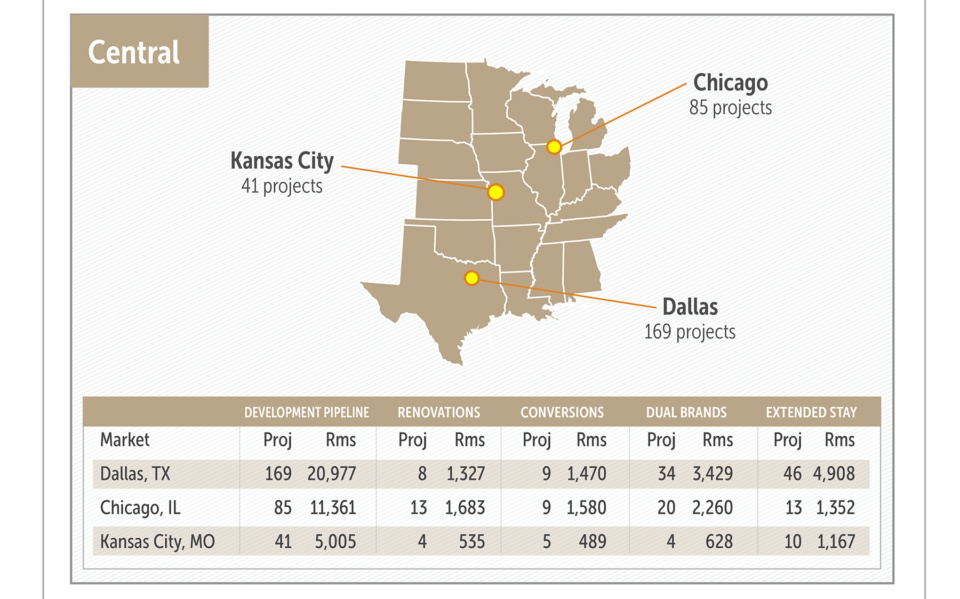

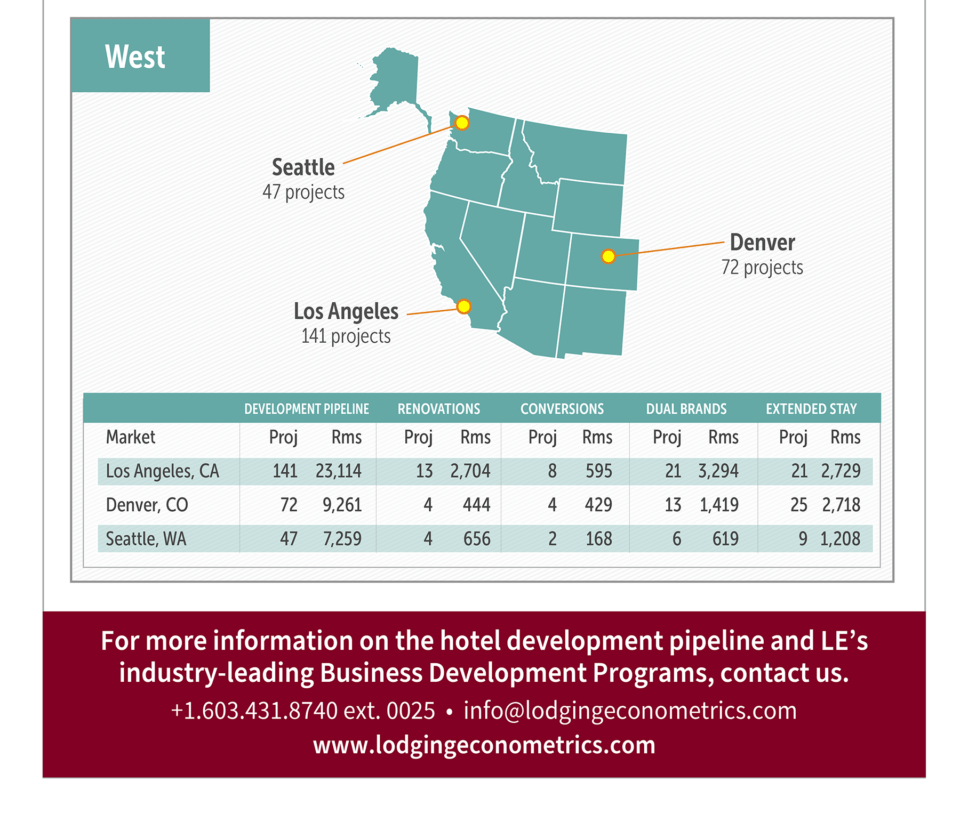

With a heavy focus on markets at year-end 2021, our graphic this quarter splits the U.S. into three regions and provides a more detailed snapshot of some of the top markets of interest. The graphic includes pipeline information on topics of elevated interest such as renovations, conversions, dual-branded projects, and extended stay projects.

At the end of Q4 ’21, the total U.S. Hotel Construction Pipeline stands at 4,814 projects/581,953 rooms. The East region of the U.S. has 1,723 projects/214,119 rooms and makes up 36% of the projects and 37% of the rooms in the total pipeline. The Central region has 1,874 projects having 206,799 rooms and accounts for 39% of the projects and 36% of the rooms in the pipeline. The West region, at the end of Q4 ’21, has 1,217 projects/161,035 rooms and accounts for 25% of the projects and 28% of the rooms in the total U.S. pipeline.

The East region has the most larger-scale renovation projects underway with 207 projects/40,346 rooms, at year-end 2021. New York leads the East region in larger scale renovations with 15 projects. The most conversion projects in the U.S, are happening in the central region with 316 projects/32,791 rooms.

At the close of 2021, the Central region overall, contains the most dual-branded projects with 410 projects, accounting for 40,855 rooms. Dallas has the most dual-branded projects in the Central region with 34 projects. This is followed closely by Atlanta, in the East region, with 32 projects. Of the 1,517 projects/157,064 rooms in the extended-stay segment, 42% of the projects are in the Central region, 32% are in the East region and another 26% are in the West region.

To stay updated on changes and additions to the hotel development pipeline, contact Lodging Econometrics. Our industry-leading database of hotel records with contact information for decision-makers can provide you with a comprehensive look into any market in the United States as well as any market around the world. LE has the most accurate intelligence on the hotel construction pipeline by stage, new project announcements, announced renovations, brand conversions, extended-stay brands, dual-branded projects, unbranded hotels, open and operating hotels, recent sales transactions and more. LE’s database of hotel records is continuously updated, accurate, and actionable. To contact LE: (603) 431.8740. ext. 0025 or [email protected].

JP Ford, ISHC, SVP, Director of Global Business Development, Lodging Econometrics

Bruce Ford, SVP, Director of Global Business Development, Lodging Econometrics

Tom O’Gorman, Vice President of Sales, Lodging Econometrics

April Bedell, Sales Account Executive, Lodging Econometrics