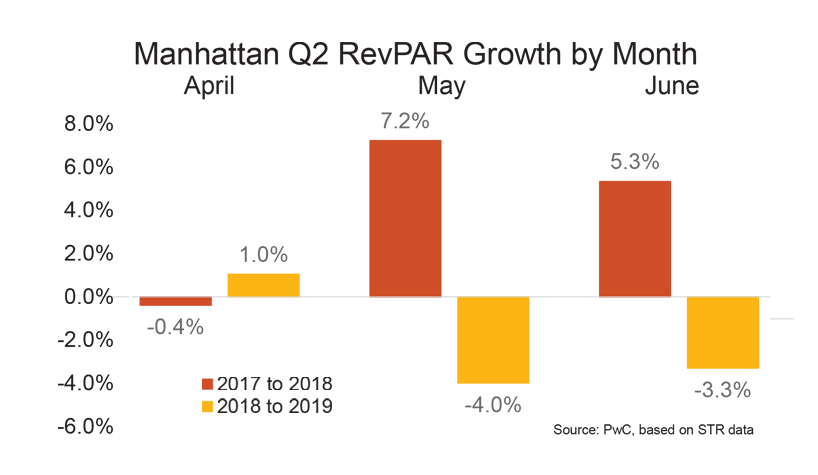

NEW YORK—During the second quarter of 2019, RevPAR in Manhattan fell 2.2%, as both ADR and occupancy declined. Demand did not keep up with the growth in lodging supply of 3%, with occupancy falling 0.9%. Six months in, RevPAR across the market was down 4.3% through June, with declines in occupancy and ADR contributing equally to this drop.

“Continued increases in supply, coupled with pressures on demand stemming from continued trade tensions and slowing economic growth, are having a profound impact on Manhattan hotels,” said Warren Marr, managing director, PwC. “In addition, inbound leisure travel from China was also impacted due to the devaluation of the yuan.”

Across all Manhattan hotel classes, upper-upscale properties exhibited the most notable decline in RevPAR during the second quarter. Decreasing by 2.7% from prior-year levels, upper-upscale RevPAR was largely driven by a decline in ADR of 2%. For upscale hotel properties, where occupancy fell by 0.5%, Q2 RevPAR was further impaired by a decline in ADR of 1.1%. Luxury hotels saw the only gains in ADR, up 0.5%, with declines in occupancy driving a decrease in RevPAR of 2% for the quarter. Of the four hotel classes tracked, upper-midscale hotels posted the smallest decline in RevPAR, with occupancy and ADR each declining 0.4%.

During the second quarter, four of the five Manhattan neighborhoods experienced declines in RevPAR. As occupancy and ADR largely fell across the board, the Midtown East submarket posted the largest ADR-driven decline in RevPAR of 3%. For the Midtown West submarket, where RevPAR declined 2.9%, ADR and occupancy decreased 1.1% and 1.8%, respectively. For Upper Manhattan, where occupancy declined by just 0.1%, year-over-year decreases in ADR drove a half percent reduction in RevPAR.

During the quarter, Lower Manhattan posted a decline in ADR of 2.7%. Despite an increase in room demand of 11.5% over the same period last year, growth in room supply of 11.1% served to minimize potential growth in occupancy during the quarter.

Of the five Manhattan neighborhoods tracked, only Midtown South posted positive year-over-year growth, with RevPAR increasing by a marginal 0.1%, driven solely by occupancy.

For full-service hotels, RevPAR was more impacted than that of limited-service properties between April and June of 2019, with year-over-year declines in ADR of 1.2% and 0.2%, respectively, and declines in occupancy of 0.8% and 1.3%, respectively.

RevPAR for chain-affiliated hotels proved to be more impacted than that of independent properties. For the second quarter, both chain-affiliated and independent hotels experienced declines in ADR of 1.5% and 0.9%, respectively. However, with growth in occupancy of 0.2% for independent hotels, and declines of 1.5% for chain-affiliated hotels, RevPAR for chain-affiliated hotels was down 3% from prior-year levels, compared to 0.8% for independent properties.