NATIONAL REPORT—The U.S. construction pipeline is now in its ninth consecutive year of growth and should continue to remain strong through 2020 and the early part of the new decade.

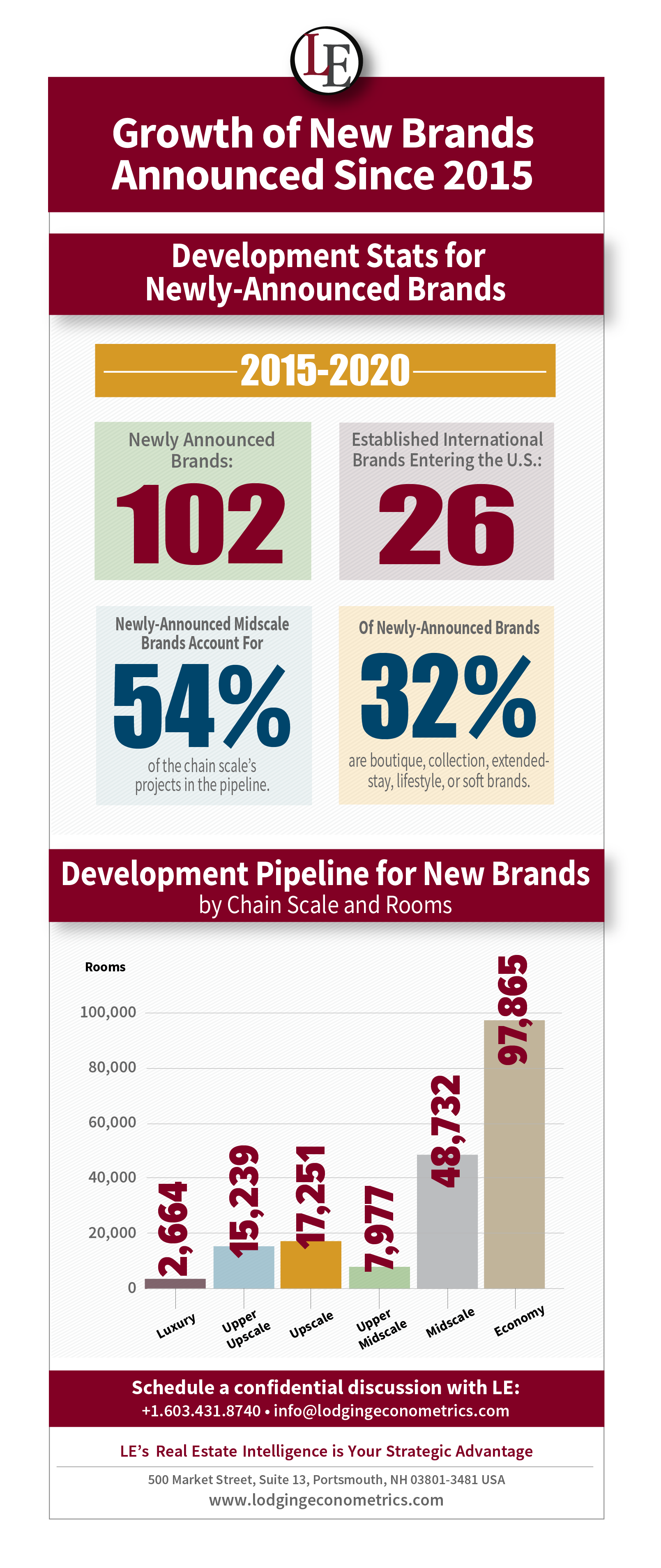

This lodging development cycle for the hotel industry has resulted in the announcement of 102 new brands since 2015, some new builds, others conversion brands. Twenty-six of these brands are established international brands that have announced U.S. growth plans. Many of the other brands are a result of the major franchise companies expanding their development offerings to meet the desire of travelers for a more “unique” place to stay, while remaining competitive in the ever-changing travel market. In fact, of the 102 newly announced brands, 32% are boutique, collection, extended-stay, lifestyle or soft brands.

The chain scale with the fastest rate of growth for newly announced brands is the midscale chain scale. With 510 projects/48,732 rooms, newly announced brands in the midscale chain scale account for 54% of the chain scale’s total development (new construction and conversion) pipeline projects in the U.S. The economy chain scale has the greatest number of rooms from newly announced brands in the development pipeline with 97,865 rooms. The luxury, upper-upscale, upscale and upper-midscale, respectively together, comprise 307 projects/43,131 rooms of the total U.S. development pipeline.

The three largest hotel franchise companies in the U.S., Marriott International, Hilton and InterContinental Hotels Group (IHG) have launched a combined nine new brands since 2015. Other companies such as Best Western Hotel & Resorts top the new brand announcement list with 10 new brands, Accor has nine and Hyatt Hotels has introduced seven.

Newly announced brand growth is expected to continue well into this decade as these brands begin to gain traction and development begins or continues.

Lodging Econometrics (LE), the trusted advisor in delivering comprehensive and actionable global hotel intelligence, decision maker contacts and unparalleled service, can provide you more information on these brands or other details of the hotel construction pipeline in the U.S. or any other region, country, market or city in the world. Contact us for more information: +1 603.431.8740 or [email protected].

—JP Ford, ISHC, SVP, Director of Global Business Development, Lodging Econometrics

—Bruce Ford, SVP, Director of Global Business Development, Lodging Econometrics

—Tom O’Gorman, Vice President of Sales, Lodging Econometrics

—April Bedell, Sales Account Executive , Lodging Econometrics