Industry experts at the 15th annual BWH Hotel Group Travel Summit held virtually last week were optimistic about the return of leisure travel as the pandemic slows.

The panel discussion, led by Dorothy Dowling, SVP/CMO, BWH Hotel Group, focused on traveler sentiment, road and summer travel, as well as trends reshaping the industry’s rebound. Other panelists included Greg Staley, SVP, communications, U.S. Travel Association; Nelson Boyce, managing director, travel, Google; and Paula Twidale, SVP, Travel, AAA. The expert panelists highlighted top trends shaping the return of travel and discussed how stimulus checks, savings and the vaccine rollout have impacted consumer sentiment and pent-up travel demand.

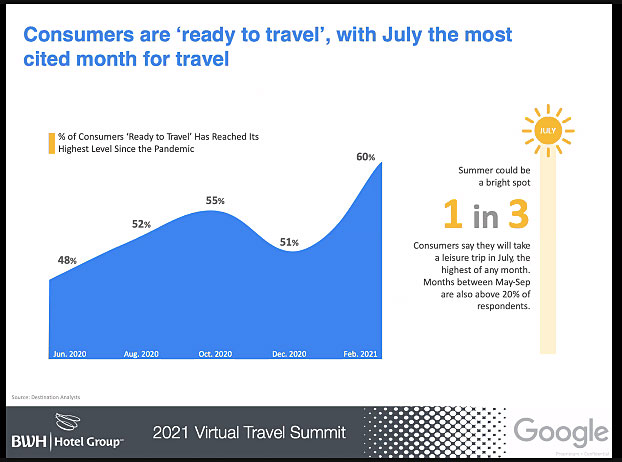

“The good news is that consumers want to travel,” said Boyce. “The pandemic has changed things, but not our desire to travel. We see in research and surveys, once the pandemic is over, consumers will prioritize travel over other purchases such as clothes, concerts or cars.”

Coinciding with this year’s summit was the return of AAA’s Memorial Day Holiday Travel Forecast. AAA’s findings predict that 37 million Americans will travel this Memorial Day weekend (May 27-31), a 60% year-over-year increase from the 23 million Americans that traveled during the same time period in 2020.

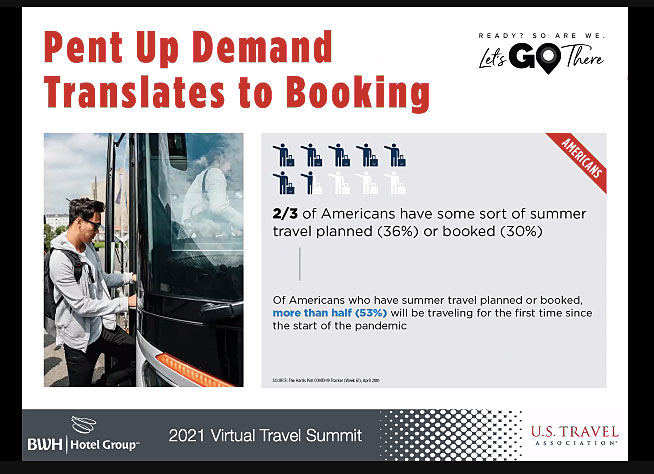

In addition to AAA’s Memorial Day Holiday Travel Forecast, U.S. Travel presented encouraging statistics during Friday’s Virtual Travel Summit taken from a recent Harris Poll:

- 77% of Americans are planning on traveling this summer (compared to 29% in 2020)

- Two-thirds of Americans have a summer trip either already planned (36%) or booked (30%)

“Now with vaccinations rising, infection rates falling and restrictions easing nationwide, leisure travel is poised for a summer comeback,” said Staley.

A key topic discussed during the summit was loyalty and the evolution of consumer behavior. Data presented by Google showed that 36% of consumers have tried a new brand amid the pandemic, with the top criteria for switching being availability, convenience and value. Of those 36% of consumers, 73% intend to incorporate the new brands into their routine. These trends, which come from McKinsey survey research, show that consumers are switching brands at unprecedented rates and signifies the need for travel loyalty programs to be enhanced and reimagined to connect with consumers post-pandemic.

An important trend addressed during the summit was how consumers are relying more on digital to book their next vacation. According to Google, consumers are looking for help and travel inspiration as they are unsure of where to go, with a popular search query being “where to travel to.” The pandemic led to much higher time spent on digital video and social media: +25% and +16% year-over-year, respectively.

Additionally, the average window for booking flights and hotels with intent has decreased, while the average window for researching, finding inspiration and taking all necessary COVID-related precautions has increased.

While most of the session dealt with leisure travel, when asked by Hotel Business about the return of business travel, Dowling said that she expected to return in Q4, but more so beginning in 2022, adding, “Some of it is tied to office return for sure, and we know that a lot of companies are in the midst of doing that. Certainly, by Labor Day, many companies are going to be back in force in their office. But the buyer sentiment, when we engage with them, is that they are very dialed in terms of safety and security, and duty of care has been elevated to a level I have not seen in my career. The buyer wants to be extraordinarily well-informed as to what the supplier is doing in terms of supporting their needs.”