By Stefani C. O’Connor

If the adage “whatever doesn’t kill you makes you stronger” rings true, lodging industry denizens likely feel pretty Herculean as 2023 kicks off. Having weathered the past several years of unexpected/unprecedented intense disruption, stalwart owners/operators/developers/brands are up for any positive news and, according to industry experts, there is some to welcome.

“Obviously, the biggest positive is that we, and most in the industry, believe RevPAR will grow amid a recession, albeit a shallow one,” said Amanda Hite, STR’s president/CEO. “If we are correct in our outlook, this will be the first time RevPAR rose when the economy is contracting. This highlights the increasing interest in travel and hotels by consumers, ensuring the long-term viability and, ultimately, profitability for the entire hotel industry ecosystem.”

STR is anticipating hotel-demand recovery this year, although the CEO indicated occupancy will take a few more years to reach pre-pandemic levels as the industry adds new supply. “The good news is that supply growth is expected to remain below the long-term average of 1.8%, and that’s going to help occupancy rebound,” she said.

Regarding investment performance metrics, Rachael Rothman, head of hotels research and data analytics, CBRE Hotels, said hotel cap rates decompressed slightly more in Q3 2022 and at a much slower pace compared to other CRE (commercial real estate) sectors. She added price per key was stable, with limited-service properties seeing increases and full-service properties experiencing declines, while total transaction volume is down.

“The slower reopening of amenities and the delayed return to certain segments of the business have resulted in margins exceeding 2019’s levels on a short-term basis,” said Rothman. “As amenities reopen, group and FIT business travel return, and hotel revenues shift toward lower-margin F&B, spa, etc., we expect margins to compress, but higher rates and higher occupancy levels should help shield profit increases.”

Hite concurred the rise in remote work also will be a boon. “Individuals are not tied to an office Monday through Friday,” she said. “They can work from their hotel room anywhere, which is essentially a new form of business travel even though traveling funds may come from the individual themselves. Regardless, this will boost travel and use of hotels.”

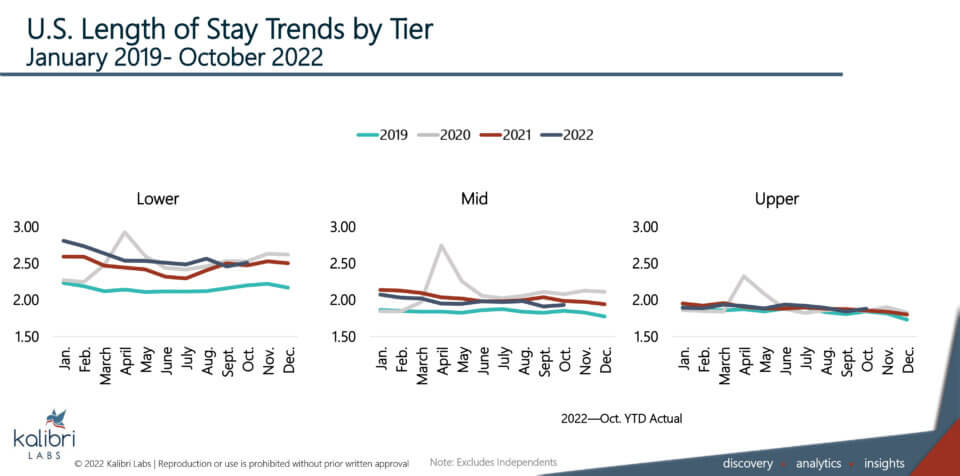

One adjunct to this and one of the major industry changes over the past two years is average length of stay, which from 2015 through 2019 was consistently about 1.9 nights, meaning the overwhelming majority of stays was one night, according to Kalibri Labs’ data.

“During the pandemic that shifted upward to about 2.1 nights and has stayed in the range consistently,” said Kalibri Labs’ Partner/Senior Advisor Mark Lomanno, citing transient leisure demand taking a larger share of total room night demand than it had historically as a partial reason. The LOS has remained in the 2.1 range despite greater transient corporate demand in second-half 2022.”

He added, “Interestingly, the properties in the lower and middle tiers have been the major beneficiaries of this new trend. [See chart above.] To put this change in perspective (making a few assumptions regarding occupancy levels, room supply), every 0.1 change in LOS results in about 40,000 fewer guest check-ins. So where the LOS is 2.1 nights on average, there are about 80,000 fewer check-ins every day. The obvious conclusion is that there are fewer travelers than historically, but they are staying at the hotels longer. Should this pattern continue, it would be an extremely positive development for the hotel industry as corporate and group travel continue their return.”

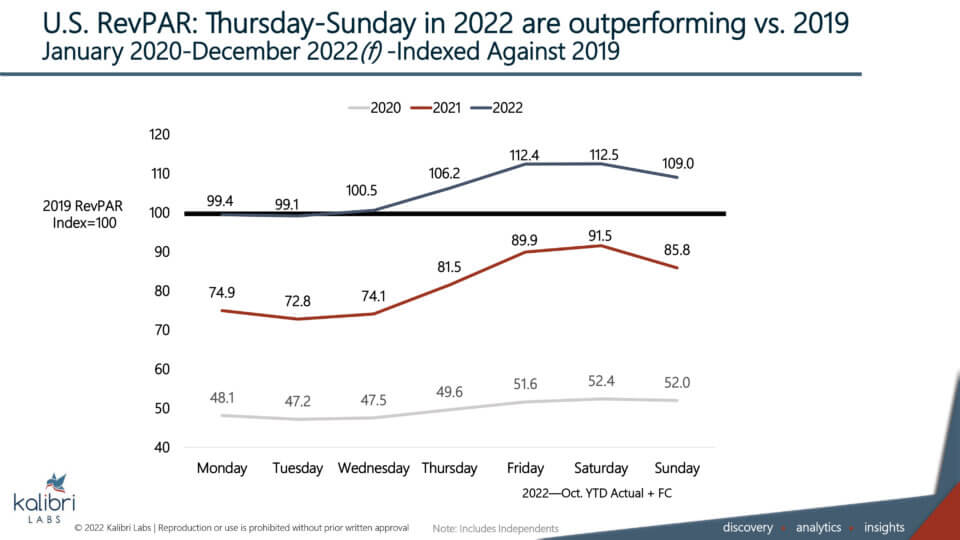

With transient leisure guests staying longer it’s not surprising the so-called “shoulder days”—Sunday and Thursday—have been the primary beneficiaries of these longer stays, added Lomanno, with each of those days’ RevPAR index well above 2019 levels, outperforming the traditional weekdays of Monday through Wednesday. (See chart below.)

“The improvement seen on those days is a combination of demand that is at or slightly above pre-pandemic levels but with ADR growth well above what was achieved in the historical period,” said Lomanno. “Conversely, the traditional weekdays’ RevPAR is just about back to 2019 levels, with demand still well below where it was in the past but [with] ADR well above what [was] achieved historically. The industry’s ability to increase ADR even with demand still relatively soft on those days bodes extremely well…as the expectation is during 2023 both corporate and group will continue their rebounds.”

Check out what other industry movers and shakers see ahead this year in Hotel Business’ U.S. Hotel Industry Outlook 2023, sponsored by Sonesta.