The planning of new hotel projects, announced renovations and brand conversions is driving the development rebound of the lodging industry. Analysts at Lodging Econometrics (LE) have found that hotel developers and owners are moving forward in the planning of new hotel construction projects at a rapid pace. They are also renovating and repositioning their existing properties to take advantage of the recovery and, otherwise, setting themselves up for a long post-recovery run.

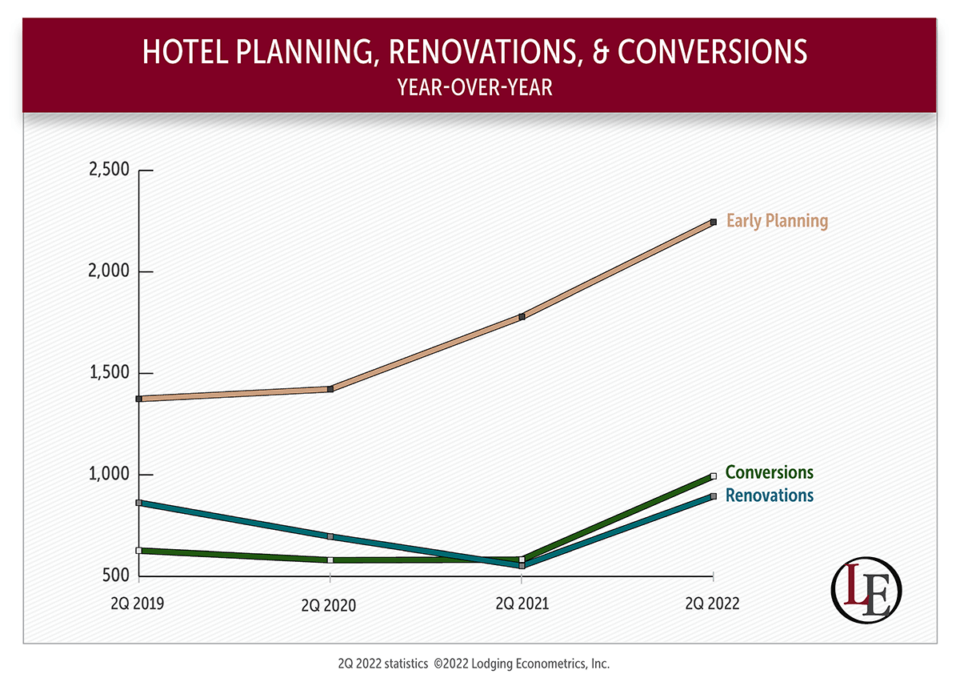

In Q2 ’22, there were a total of 428 new hotel construction projects accounting for 47,034 rooms announced into the pipeline. This number more than doubled year-over-year (YOY) when compared to the second quarter of 2021 when 202 new hotel projects/25,653 rooms were recorded. Also, at Q2 ’22, there were a total of 2,009 projects/232,163 rooms scheduled to start construction in the next 12 months, up 9% YOY by projects and 9% YOY by rooms. Projects in the early planning phase closed out Q2 ’22 with 2,246 projects/258,191 rooms–an all-time high!

Additionally, at the end of Q2, there were a total of 1,889 projects/237,420 rooms in the renovation or conversion pipeline in the U.S., with conversions reaching an all-time high and increasing an astounding 66% YOY by projects and 35% YOY by rooms. At the end of Q2 ’22, announced renovations accounted for 895 projects/140,139 rooms and brand conversions accounted for 994 projects/97,281 rooms. Thirty-seven percent of projects in the renovation and conversion pipeline are in the early planning phase, six months or so from starting.

Markets like Houston, Atlanta, Chicago and Dallas have 30 or more renovation and conversion projects in their pipelines. Of the top 50 markets in the U.S., ten markets have 20 or more renovation or conversion projects. These ten markets account for 39% of the renovation and conversion projects in the top 50 markets.

Brands like Holiday Inn Express, Holiday Inn, Hilton Garden Inn, Candlewood Suites and Staybridge Suites have the most renovation activity at the end of Q2 ’22. Brands with the largest new construction pipelines at the end of Q2 ’22 are Home2 Suites by Hilton, Holiday Inn Express, TownePlace Suites, Fairfield Inn, Residence Inn, Tru by Hilton and Hampton Inn & Suites by Hilton.

The recovery is in full swing, and developers and owners are not wasting any time!

For more information on the construction pipeline, announced renovations, and brand conversions in any region, country, market, city, complete with decision-maker contact information, contact Lodging Econometrics at +1 603-431-8740 Ext. 0025 or https://www.lodgingeconometrics.com