NEW YORK—The U.S. hotel industry is projected to continue posting record-breaking performance levels through 2019, according to STR and Tourism Economics’ revised forecast released at the NYU International Hospitality Industry Investment Conference here.

“RevPAR growth exceeded expectations during the first quarter of the year and lifted our projections for 2018 as a whole,” said Amanda Hite, STR’s president/CEO. “However, because of the post-hurricane demand boost in 2017, we expect year-over-year occupancy declines during Q4 that will extend into 2019 with that year’s total overall performance affected.”

She continued, “Regardless, industry fundamentals continue at record levels supported by strong demand from both the business and leisure sectors. Solid economic indicators and a room construction total that represents just 3.6% of existing supply certainly help marketplace conditions as well.”

2018

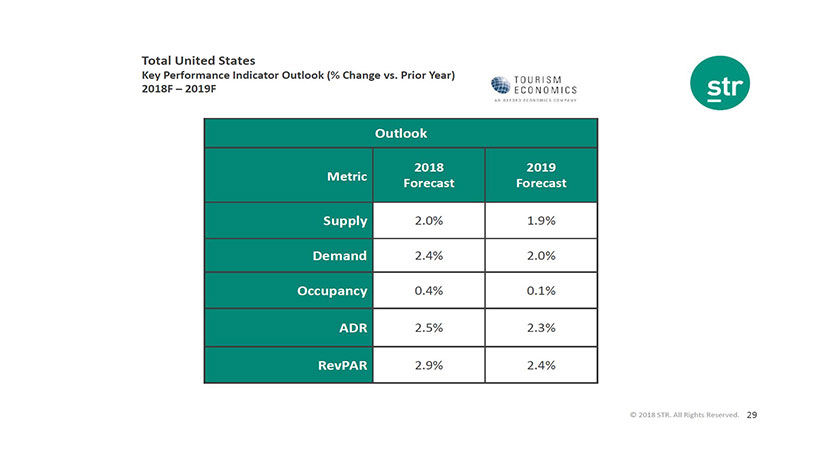

For the total year, the U.S. hotel industry is projected to report a 0.4% increase in occupancy to 66.2%, a 2.5% rise in average daily rate (ADR) to $129.74 and a 2.9% lift in revenue per available room (RevPAR) to $85.89. RevPAR grew at least 3% for each year from 2010 to 2017.

The luxury chain scale segment is likely to report the largest increases in occupancy (+0.9%), ADR (+2.9%) and RevPAR (+3.8%). While all segments should report increases for 2018, the lowest rate of RevPAR growth is projected in the upscale segment (+1.8%).

All but one top 25 market (Houston) is projected to report RevPAR growth for the year. While most markets are projected in the 0% to +5% range, Minneapolis/St. Paul, Minnesota-Wisconsin, is the only U.S. top 25 market expected to see growth in the range of +5% and +10%.

2019

For 2019, STR and Tourism Economics project the U.S. hotel industry to report a 0.1% increase in occupancy to 66.2%, a 2.3% lift in ADR to $132.74 and a 2.4% rise in RevPAR to $87.93.

The highest overall rate of RevPAR growth is expected in the upper-upscale segment (+2.3%), while the lowest is projected among upscale (+1.9%) and midscale (+1.9%) chains.

Different from this year, Minneapolis is the lone top 25 market projected to report a negative RevPAR percent change for the year. The remaining 24 markets are expected to post growth between 0% and 5%.