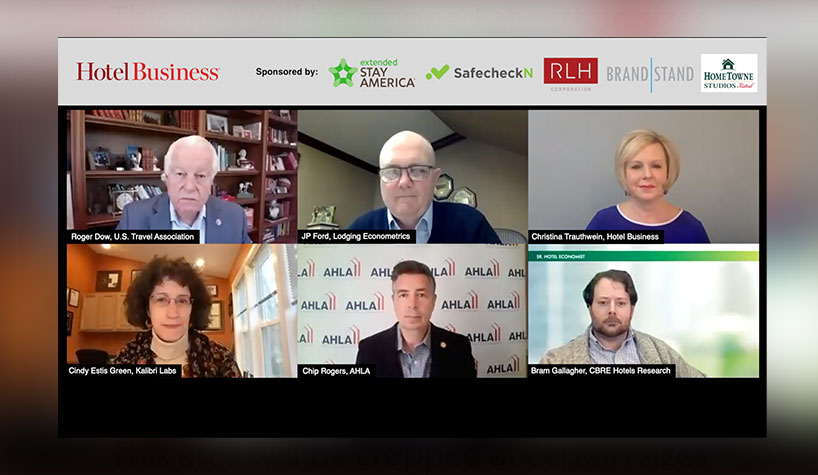

The Hotel Business Hot Topics virtual series, “Industry Outlook 2021: Numbers & Analysis,” brought together industry experts to discuss the current state of travel for 2021 and beyond.

Moderated by Hotel Business VP of Content and Creative Christina Trauthwein, the panel featured Roger Dow, president/CEO, U.S. Travel Association; JP Ford, SVP, Lodging Econometrics; Bram Gallagher, senior hotel economist, CBRE Hotels Research; Cindy Estis Green, CEO/cofounder, Kalibri Labs; and Chip Rogers, president/CEO, AHLA.

While the leaders presented thoughtful insight into everything from the future of business and leisure travel to how technology including Zoom and the COVID vaccine will impact the industry, an hour was simply not enough to address all of the audience questions. Hotel Business is continuing the conversation and has reached out to the panelists to share some more of their thoughts:

Is anyone on the panel willing to suggest a meaningful way to move forward while empowering the medical professionals including the CDC?

Dow: We absolutely can move forward together. Travel can be done safely when we implement a layered approach to health and safety, which we have advocated for and supported since the beginning of the pandemic. We have been engaged with the Centers for Disease Control and Prevention (CDC) and other agencies in the administration to encourage policies are science-driven and risk-based, scalable and feasible. A zero-risk tolerance will not allow for the reopening or recovery of the economy. Traveler safety has always been our industry’s top priority. We have taken this commitment further: health and safety is the new hospitality. We have adopted new policies and technologies to prioritize the safety of our guests and employees, while also encouraging people to follow public health protocols and, when available, get vaccinated.

What about the hybrid events? How will they impact the return to in-person meetings, since some companies learned that virtual events are sometimes cheaper and not all issues require travel to be solved? How will all these impact business transient travel and meetings?

Dow: The travel industry cannot recover without the return of business travel, meetings and events, which fell by 70% and travel businesses and our workforce is suffering without this demand. Pre-pandemic, nearly 500 million business trips were taken in the U.S.—a number that had been steadily increasing over 10 years. These travelers spent a total of $334 billion, including $94 billion on lodging and $70 billion on air transportation. This spending supported 2.5 million American jobs. Despite making up 20% of total trip volume, business travelers accounted for 30% of total travel spending in the U.S. and nearly 40% of lodging and air revenue. It is estimated that business travel contributes up to 70% of global revenues for high-end hotel chains and 55%-75% of airline profits. The fact is, professional business events are distinct from social or “mass gatherings” and occupancy limits should be adjusted to permit a safe restart of meetings and events. The structured environment of a professional business meeting or event, where physical distancing is enforced and time spent within meeting environments can be minimized, is distinct from other forms of social gatherings, meaning it should be possible to conduct business events that adhere to healthy and safe gathering practices.

When do the panelists think business transient demand returns to 2019 levels? And what is the catalyst outside of general vaccination?

Dow: We anticipate corporate and group business travel to return later than leisure. It is hard to put a date on it, but we expect to recover most of small group business travel by 2022. Large-scale events and trade shows could take several years to return without assistance, which is why it is so critical we work with the government on the safest ways to get these sectors back up and running as quickly as possible. We do expect that widespread vaccination will play a critical role in ramping up business travel again. It is going to be a combination of factors—individual’s comfort level with traveling, updated corporate policies and varying state and local regulations on gathering restrictions. These are all things we are working to address so we can shorten the recovery.

Rogers: The truth is, business travel is expected to remain extremely low in the near term and not return to pre-pandemic levels until 2024. This presents a huge challenge as business travel is the largest source of hotel revenue. According to AHLA’s State of the Hotel Industry 2021 report, nearly half of consumers see vaccine distribution as key to travel, and we stand ready to help local, state, and federal officials to offer hotels as locations for efficient, timely distribution of the COVID-19 vaccine.

Please discuss the impact of prolonged use of Zoom-like technology as it relates to slowing down recovery for business travel. Will companies be less supportive of person-to-person meetings as a result of Zoom representing a less expensive alternative?

Rogers: The hotel industry has long been a champion of evolving technologies in order to continue to provide guests with the best possible product. But I would say that for a lot of people, this public health crisis has shown how valuable in-person meetings are, and while it may take some time to get back to “normal” levels, we believe the desire for those in-person meetings and events will still be there. In the meantime, hybrid and virtual meetings are a great option and align with the industry’s commitment to keeping guests safe.

Gallagher: Teleconferencing will have mixed effects as it represents a substitute for travel in some cases but a complement in others. Routine meetings and updates are able to be done over Zoom, but also help us to maintain contact with people we benefit from seeing face to face. If work-from-home becomes more entrenched, hotels are well-positioned to provide the venue for the personal interaction on a more flexible basis compared to conventional office space. Returns to business travel have been high, and businesses have been motivated to invest in travel for good reason—teleconferencing will not completely supersede the value of physical travel.

Why do you think the extended-stay properties have done fairly well in the last year?

Estis-Green: The only length of stay tier in which there was an uptick in 2020 was stays of 5+ days—that was in both extended-stay and traditional hotels. The shorter stays declined across the board in all chain scales and hotel types. There are a few likely reasons for this:

(1) the COVID-related business such as traveling nurses or national guard were project-based so were comprised of longer stay groups;

{2) one type of business that didn’t disappear during COVID was residential business since extended-stay properties normally have some base of short-term rental for temporary dislocations, relocations or for those who have to pay for housing weekly and can’t afford a mortgage; and

(3) those who could “work from home” could also work from any remote location so the business that used to be weekend stays on Friday/Saturday became longer weekends from Thursday-Sunday or even full weeks since the guest could take a few days off and work in the hotel the other days. To avoid interaction with others and for safety purposes, having a kitchen facility made this easier—extended-stay are the primary supply with the amenities to accommodate this need.

Rogers: The data over the past year has shown that drive-to and coastal destinations fared better than their urban and city-center counterparts. Extended-stay properties offered the perfect accommodation for road trippers and those seeking a quick getaway. According to STR, these properties, especially motels, have built-in social distancing, often with exterior corridors and stairs over elevators.

Gallagher: Extended-stay properties cater to temporary residences and compete to some extent with multi-family. Mobility has not been very high during the pandemic despite talk of flight to the suburbs, and extended-stay properties have seen smaller effects from social distancing measures because of that. There are also some medical and emergency workers that have been relocated during the pandemic, stimulating some demand for extended-stay.

Can you touch on why midscale and economy hotels/brands are leading the current recovery? Any brands in particular?

Estis-Green: The middle and lower-tier hotels (upscale, upper-midscale, midscale and economy) are leading the recovery because they rely least on large national corporate accounts and related group meetings. The U.S. hotel industry lost more than 50% of its revenue during COVID and much of it was for corporate and group business. Upper-tier hotels are 50%- 60% dependent on business travel and more of upper-tier supply is located in major markets where those travelers arrive by air. The larger corporate accounts that contribute transient and group business travel are also more likely to be guided by liability concerns that will create restrictions on employee travel related to “duty of care.”

On the other hand, mid and lower-tier hotels:

(1) don’t have the meeting space for the larger groups—most are well under 5,000 sq. ft.

(2) the corporate accounts that use the middle and lower-tier tend to be more regional and local in nature and often arrive by car (not air) so this business was quicker to return without having to wait for air travel to resume;

(3) the local/regional corporate accounts tend to be smaller and likely to have fewer restrictions imposed relative to liability for travelers as many may not even have documented travel policies.

(4) many are located within four-five hour drive radius of major markets so offer leisure or work/play options for those residing in major markets who want to get away without getting on a flight.

Certainly, we all care about our industry, but we have had these conversations about economy vs. pandemic response for months, and it is widely attributed to be one of the reasons the pandemic has lasted so long and impacted us to this degree.

Gallagher: I am in agreement here. I think the historical data would bear out that prosperity follows public health more than the other way around. Moreover, the safety and availability of hotels themselves is not the most likely factor keeping people from traveling right now. Travel should return after there is confidence that destinations are safe, and this will likely only come from wide-scale vaccinations. Placing direct, short-term economic outcomes on the same scale as human lives in policymaking (which have long-term, significant economic impacts) is inhuman let alone fiscally narrow sighted.

Based in Argentina, we all look to the U.S. as an exemplary market. It would be interesting to see the U.S. outlook on global travel.

Dow: We are looking forward to welcoming back travelers from around the world to the U.S. We are proactively working with the administration and strongly urging a timeline for a safe reopening of our borders to welcome international inbound travelers back to the United States. A key component will be taking a science-driven and risk-based approach. Currently testing is required for all international inbound passengers permitted into the U.S. Quarantines are big deterrents for travelers—83% of international travelers will not fly if they have to quarantine upon arrival. Yet, 88% of international travelers are willing to be tested for COVID-19. With the international testing requirement in place and more people getting vaccinated, we would like to see a movement away from the CDC recommended quarantine guidance for inbound passengers and furthermore, we would like the federal government to lift the 212(f) travel restrictions in place on many countries. U.S. Travel is committed to hosting IPW—the leading international inbound trade show—later this year in Las Vegas. This show, which brings together top travel buyers, suppliers and the media, would be the first travel trade show to reconvene the world in-person and we are optimistic we will be in a position to hold this event safely and successfully come September.

Nothing about digital health passports?

Dow: Restoring international travel is critical to a robust recovery and presents a set of unique challenges—particularly when it comes to health and safety. The industry has done an outstanding job adopting innovative touchless technology and it will become an engrained part of the travel experience moving forward. Digital health credentials may be an important tool to help with standardizing, for example, international inbound testing verification. However, it is important to note that there should not be a requirement to have a digital health credential in order to travel. And these credentials should be interoperable throughout the travel ecosystem. Furthermore, we urge careful consideration in referring to digital health credentials as “passports”—as that implies they are requirements to travel.

Have there been more conversions in 2020 than we’ve typically seen? Are they in typical types of markets (urban, rural, etc.) or certain regions?

Gallagher: Outside of a few cases in New York and the West Coast, I haven’t heard of a rash of conversions yet. I think the business rule during times of great uncertainty is to defer investment decisions, including conversion efforts, so this may change moving into next half.

Many companies have left corporate negotiated rates at the levels they were to start 2020 (although without any volume). How do you foresee companies looking at these rates when they begin to put workers on the road again? Especially with the published rates out there now and on third-party channels?

Estis-Green: There is already a widespread belt-tightening in 2021 for business travel by large company CFOs who saw significant savings through remote meetings—conventions, client/vendor 1-1 meetings and intracompany using video services like Zoom. The return of this business is likely to be in this order:

(1) These CFOs will quickly realize that any client-facing activities such as sales and account management (e.g. consultant activity) will require in-person visits as soon as it’s safe from a public health point of view. The competition inherent in getting and keeping customers will demand that these companies put their client-facing teams back on the road.

(2) Incentive travel for sales or onboarding and team building that require in-person interaction to be effective will likely be the next to return driven by the competition to attract and retain qualified staff.

(3) The persistent pushback is most likely to be for intracompany travel where employees in one office travel to meet co-workers in another office—this is likely to be the slowest to recover and to get the most resistance in terms of allocation of travel budgets. If Bill Gates speculates that 50% of business travel won’t return, I would contest that due to the client and employee-driven travel being the majority of hotel room nights. While I agree that some portion of this intracompany discretionary travel may not come back at all, it is probably only 15-20% of business travel. However, it is likely to be replaced as the economy grows and the combination of client-facing activity and employee acquisition/retention will replace the room nights lost due to remote video meetings, even as technology improves in quality over the next five years.

(4) These companies will probably pushback on rates when they get back on the road because initially there will probably be some tension between the CFOs who will point out how much they saved and “Zoom worked fine” in opposition to the sales leaders who know they have to get back in front of customers. However, business travel has always been the least price-elastic of all segments as these travelers will have to travel once cleared from public health issues. Reducing rates won’t stimulate more of the business—it is the removal of public health restrictions and the urgency to see clients that will trigger the resumption of this travel. Hotels should think hard before making any major reductions in rates.

(5) Kalibri Labs forecast expects business travel will return to 2019 levels between 2024-2025 in the largest 50 markets (based on supply), however in markets 51-100 and small cities, it may return to some as early as 2023. This varies widely by market and submarket due to the industries that are the primary demand drivers to each. There are submarkets that will return to 2019 levels as soon as late 2021-mid 2022. This recovery will be highly uneven and is entirely dependent on the composition of demand in each market by rate category and industry type. Hoteliers need to know the composition of RevPAR by rate category so they know what business to pursue.

Gallagher: Rate hasn’t had quite had the shock that occupancy has had, particularly when considering the big shift in mix. To that point, ADR may see a slower recovery as the mix will be slow to shift back to as much business. Occupancies will see a slight benefit from lower supply in 2022, helping pricing power somewhat, but companies should not expect enormous discounts post-pandemic. Costs, particularly labor costs will be significant moving forward to accommodate a larger number of guests. While the industry has done a very good job streamlining, some of these costs will be inevitable and some of the burden will be shifted on to the consumer.

Do you think there will be any fluctuations in economic recovery or more straightforward than we think?

Dow: GDP is expected to rebound this year and we are optimistic that with the rise in vaccine availability and distribution, we will see an increase in consumer confidence in travel. While the economy is recovering, the same cannot be said about the travel economy just yet. The latest projections indicate that the travel industry will not fully recover until 2024 or 2025. There are signs of hope as data shows us there is tremendous pent-up demand for a return to travel. Recent sentiment reflects that nearly six in 10 American travelers are optimistic about traveling again within the next six months. For our industry to fully rebound, we will need continued relief, as well as stimulus measures to safely drive travel demand and bring back travel jobs.